Pretoria, Wednesday 1 April 2020 – The South African Revenue Service (SARS) today announced its preliminary revenue collection results in the context of global and local economic weaknesses, compounded by the worldwide COVID-19 pandemic.

The drivers of the revenue collected are the activities that SARS has taken to rebuild the organisation, the compliance culture among taxpayers and traders, as well as the performance of the economy and tax policy matters.

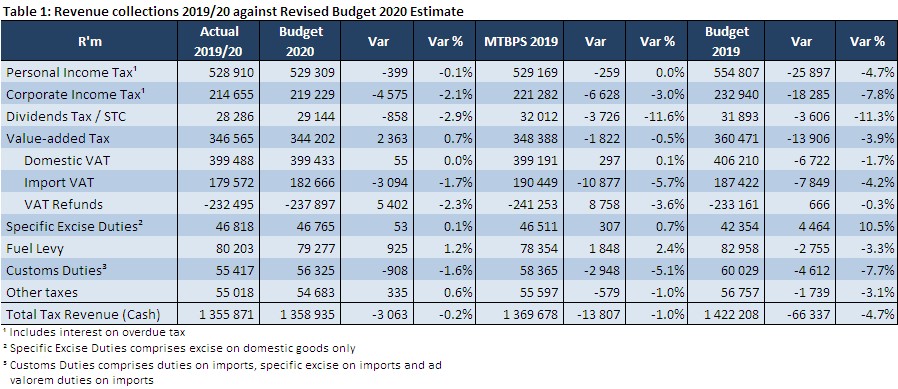

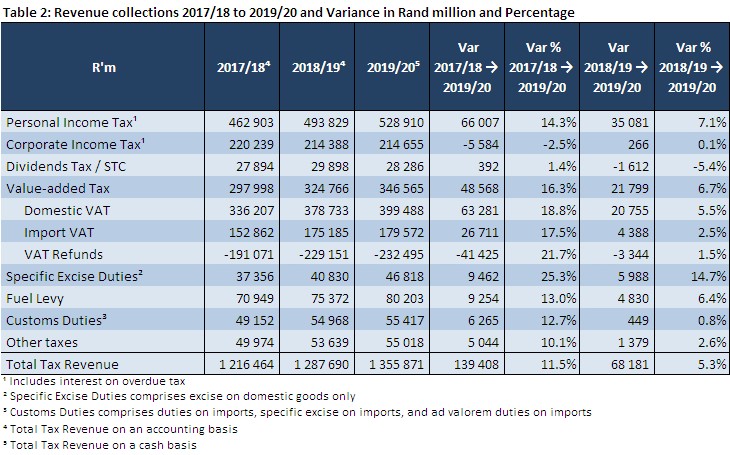

SARS has collected an amount of R1 355.9 billion in the financial year ending 31 March 2020.

The gross collected amount of R1 647.8 billion was offset by refunds of R291.9 billion, resulting in net collections of R1 355.9 billion, which represents growth of R68.2 billion (5.3%) against the 2018/19 financial year.

It should be noted that these are preliminary results, which will be subject to detailed financial reconciliation and a final audit.

Measured against the 2019 Budget Estimate of R1 422.2 billion, this results in a deficit of R66.3 billion (-4.7%), and against the 2020 Budget Estimate of R1 359.0 billion, this results in a deficit of R3.1 billion (-0.2%).

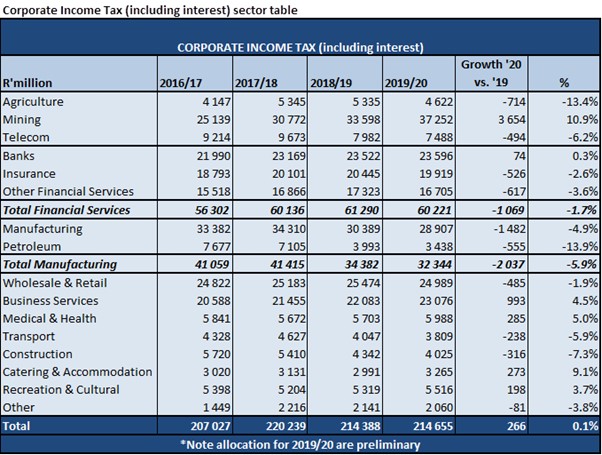

It is well understood that revenue outcomes are in the main underpinned by the state of the economy, fiscal policy choices, public confidence and administrative efficiencies. The value of economic activities consists of two components, namely a growth rate and an inflation rate. Over the past years, tax revenue collections have continued to perform below expectations driven by weak economic activity, which has led to a moderation in collection of some major tax categories. Corporate income tax collections continue to underperform, driven by reduced production in the mining and quarrying and manufacturing sector.

Pay-as-you-earn (PAYE) collections continue to be challenged by sluggish employment and wage growth. Given the current economic environment, the 2019/20 revenue is R66.3 billion lower than estimated in the 2019 Budget. Global economic growth in the 2019 calendar year has been characterised by subdued growth with growth slowing to 2.9% in 2019 from 3.6% in 2018. Furthermore, world trade remained sluggish. The WTO recently downgraded merchandise trade growth expectation for 2019 to 1.2%, down from the previous 2.6%. The downgrade is attributed to the slowing economic growth, increased tariffs, Brexit-related uncertainty, and the shifting monetary policy stance in developed economies.

Pay-as-you-earn (PAYE) collections continue to be challenged by sluggish employment and wage growth. Given the current economic environment, the 2019/20 revenue is R66.3 billion lower than estimated in the 2019 Budget. Global economic growth in the 2019 calendar year has been characterised by subdued growth with growth slowing to 2.9% in 2019 from 3.6% in 2018. Furthermore, world trade remained sluggish. The WTO recently downgraded merchandise trade growth expectation for 2019 to 1.2%, down from the previous 2.6%. The downgrade is attributed to the slowing economic growth, increased tariffs, Brexit-related uncertainty, and the shifting monetary policy stance in developed economies.

As an open economy, South Africa’s economic fortunes are partly synchronised with fluctuations in global output and demand, trade, monetary shocks, capital flows, geopolitical tensions etc. Slowing global demand and trade tensions between major economies are also affecting trade, manufacturing, confidence and investment levels domestically. Together with the weak domestic economic environment, these serve to exacerbate an already elevated risk to total revenue collections.

The South African economy entered into a technical recession as the seasonally adjusted annual GDP contracted by 1.4% q/q in Q4-2019, down from a contraction of 0.8% in Q3-2019. The economy grew by 0.2% in 2019 – low outcome compared to most forecasts. All three sectors recorded negative growth rates (primary – 0.4%; secondary – 2.9% and tertiary sector – 1.0%). The primary sector contracted with agriculture declining by 7.6% from 4.5% q/q in Q4-2019 while the mining industry reported a growth of 1.8% from -17.4% q/q in Q3-2019. The secondary sector recorded the largest negative contribution to GDP. Manufacturing declined by 1.8% from a contraction of 4.4% weighed by declines in motor vehicles and wood products. The electricity and construction industries declined by 4.0% (prior -4.9%) and 5.9% (prior -6.9%) q/q largely due to a decrease in electricity distributed and low levels of buildings completed respectively. Overall, the tertiary sector reported large contractions with the trade sector recording the highest decline due to negative growth in the wholesale and motor vehicle trade industries.

The main sources of revenue that contributed to the R1 355.9 billion collected were Personal Income Tax (PIT), which contributed R528.9 billion (39.0%), Value-Added Tax (VAT) contributing R346.6 billion (25.6%), Company Income Tax (CIT), which contributed R214.7 billion (15.8%) and Customs duties which contributed R55.4 billion (4.1%). The relative contribution of the main taxes to total tax revenue has shifted with an ever-increasing dependence on personal income tax revenue mainly due to tax policy changes. PIT remains the largest contributor to total tax revenue and its contribution has increased to 39.0% in 2019/20 from 38.4% the prior year, mainly due to partial fiscal drag relief.

The contribution of VAT and import duties continue to decrease mainly due to a weak economic growth environment with lower consumer and investment spending in the economy. CIT’s contribution to total tax has been declining over the past years, decreasing to 15.8% in 2019/20 due to low business profits and weak economic growth.

- PIT collections were slightly lower than Budget 2020 Estimate by R0.4 billion (0.1%), mainly as a result of PIT provisional tax payments which were higher than expected by R2.7 billion (9.3%) offset by lower-than-expected PAYE of R2.1 billion (0.4%) and PIT Assessment payments of R1.0 billion (6.1%).

- CIT collections are below Budget 2020 Estimate by R4.6 billion (2.1%), mainly as a result of CIT Provisional tax payments and Assessment payments which were lower than expected by R3.1 billion (1.4%) and R0.8 billion (5.5%) respectively. This performance is in spite of positive growth experienced in the Mining and quarrying sector mainly driven by the Iron ore as well as the platinum group metals (PGMs) sub-sectors. CIT performance was also boosted by positive performance in Gross Operating Surplus (GOS), which recorded a consecutive Q/Q growth of 4.3% and 4.0% in Q3-2019 and Q4-2019 respectively. The Mining and quarrying sector was the key driver in both quarters, after recording a growth of 11.1% and 7.4% in Q3-2019 and Q4-2019 respectively

However, the overall performance in CIT Provisional tax payments was negatively impacted by the contraction in the major contributing sectors such as Finance (R1.1 billion, 1.7%) and Manufacturing (R1.5 billion, 4.9) following unreliable electricity supply as well as weak business and consumer confidence. Furthermore, the falling economic activity due to the COVID-19 pandemic has caused metal prices to be on a downward spiral, resulting in lower demand for commodities thus hurting the manufacturing activity.

CIT refunds were also higher-than-expected by R2.3 billion (13.3%) against the Budget 2020 Estimate as a result of efforts to clear the IT credit book, which continued particularly for Large Business in the Manufacturing and Finance sectors.

-

Dividend Tax collections are marginally lower against Budget 2020 Estimate by R0.9 billion (2.9%). Unreliable electricity supply, stagnant commodity prices as well as the recent economic developments of the COVID-19 pandemic have impacted companies’ profitability negatively.

Furthermore, a consecutive quarterly GDP contraction of 1.4% in Q4-2019 as well as a revised contraction of 0.8% in Q3-2019 have also put more strain on DT/STC collections. The Manufacturing industry was one of the largest negative contributors to the contraction, decreasing by 3.9% and contributing 0.5 percentage point. -

Domestic VAT is R0.06 billion (0.0%) above Budget 2020 Estimate, despite high unemployment, sluggish household income growth and high indebtedness, which continue to subdue consumer spending.

-

VAT refunds are R5.4 billion (2.3%) lower than Budget 2020 Estimate, as a result of more stringent measures in an effort to curb leakage due to fraudulent claims. Gross fixed capital formation contracted in all 4 quarters of 2018 resulting in a 1.4% contraction for that year compared to a 1.0% growth in 2017. It also contracted by 4.1% in 2019-Q1 and by 10.0% in 2019-Q4 with an overall 2019 contraction of 0.9%.

-

Import VAT fell short of Budget 2020 Estimate by R3.1 billion (1.7%), mainly due to narrow growth rates from the largest commodity drivers of the tax, underpinned by the overall merchandise import level growing by just 3.2% in 2019/20 compared to the prior year (PY).

-

Customs Duties fell short of Budget 2020 Estimate by R0.1 billion (1.6%), largely drive by narrow to negative growth rates in key contributing chapters, underpinned by the overall merchandise import level growing by just 3.2% in 2019/20 compared to PY.

The negative performance of the taxes above was partially offset by the Excise collections which were R1.1 billion (0.7%) higher than the Budget 2020 Estimate.

REVENUE TABLES:

To access this page in different languages click on the links below: