Tax practitioners will not be able to register using a manual process any longer and are only allowed to register electronically on eFiling.

In order to register as a tax Practitioner:

- You must have an active tax reference number;

- Your name must reflect on the Taxpayer list, and

- You must be an Individual.

Tax practitioners will be able to check their status by contacting the SARS Call Centre on 0800 00 7277 or at the nearest SARS branch.

Top tip: Once a tax practitioner register with SARS they need to inform their controlling body to submit their details to SARS in order to finalise the registration process. Keep in mind that the Registered Controlling Bodies (RCB’s) will not automatically send the information without the tax practitioner having to inform the RCB.

Tax Practitioner Registration Process via eFiling

Navigate to www.sarsefiling.co.za and click on the “Login” button:

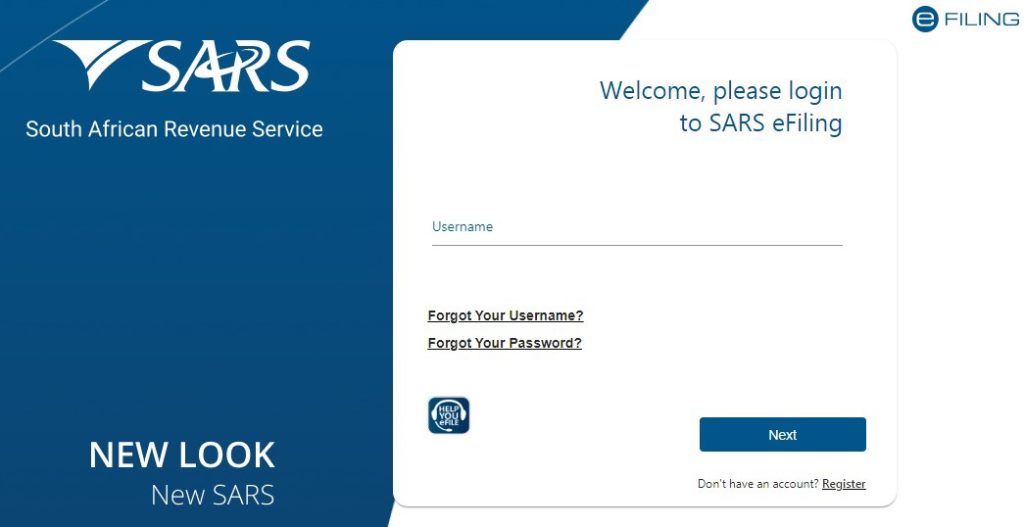

Enter your Username and Password:

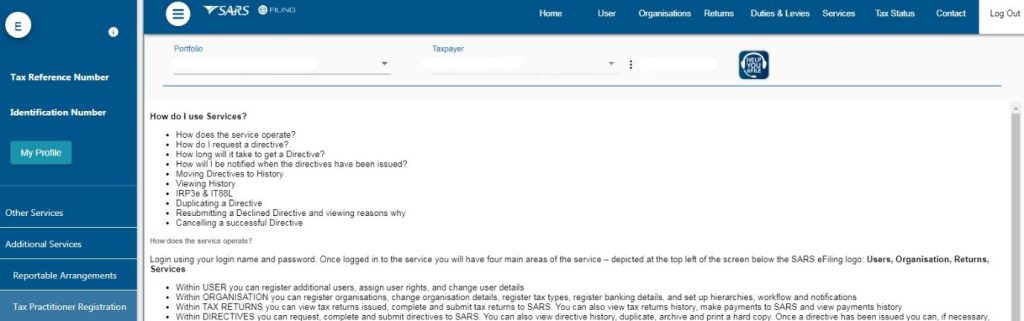

Select the “Services” menu tab and “Additional Services”. Click on “Tax Practitioner Registration”:

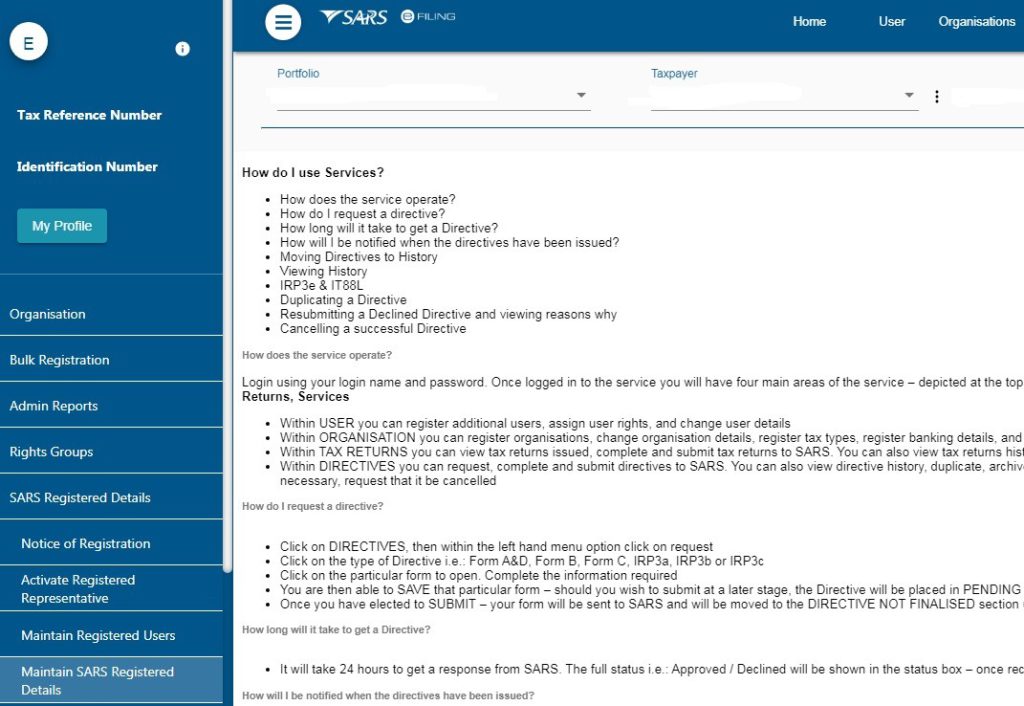

On the Organisation profile, ensure that the correct taxpayer is selected from the taxpayer list in the event of registering an individual as a tax practitioner.

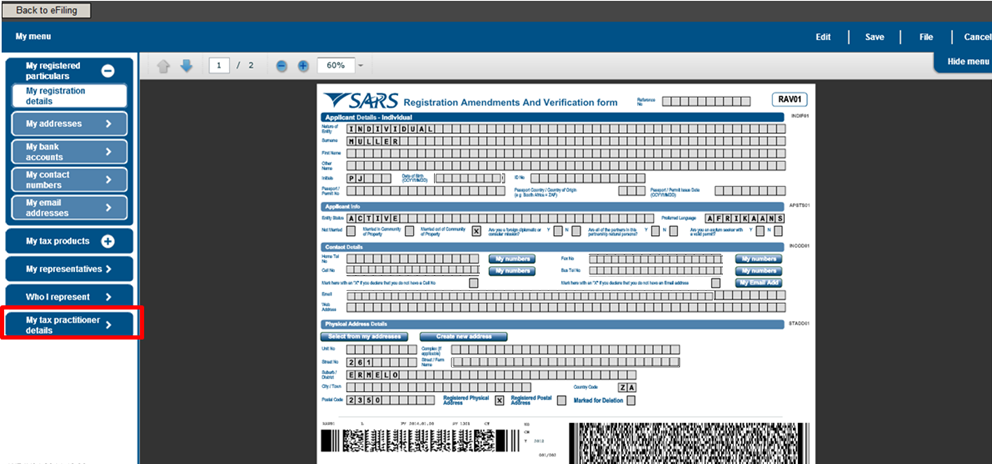

Select “Organisation” menu tab and “SARS Registered Details” to continue with the registration of a tax practitioner. Click on “Maintain SARS Registered Details” to continue.

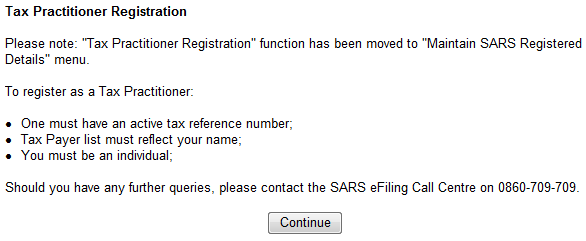

The Tax Practitioner Registration screen will be displayed to inform you that the functionality has moved to the “Maintain SARS Registered Details” menu on eFiling. Click “Continue” to proceed.

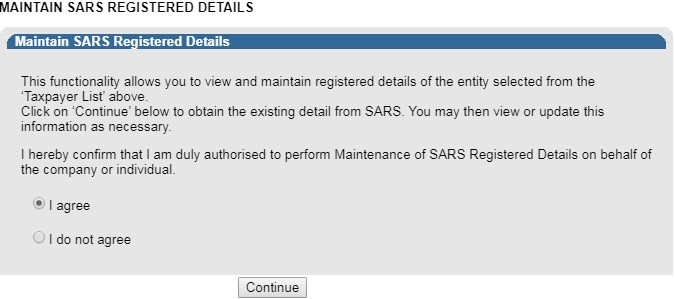

The Maintain SARS Registered Details page will be displayed. Click “Continue” to proceed.

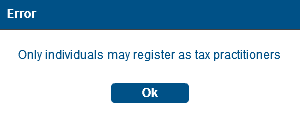

If you are not an individual, and wish to register as a tax practitioner, the following error will be displayed:

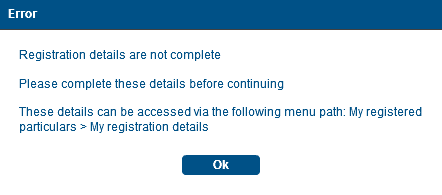

If your registration details are incomplete, you will receive the following error message when you select the “My tax practitioner details”:

Ensure that all registered details are correct before continuing to the tax practitioner section. A message containing an explanation on the details saved with SARS will be displayed and you will have to select the relevant option.

Depending on your selection above, the WRAV01 form will be displayed:

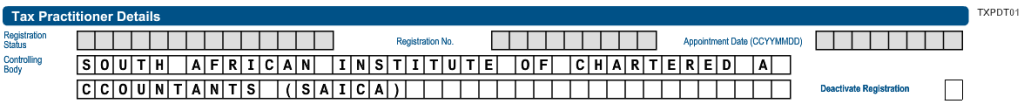

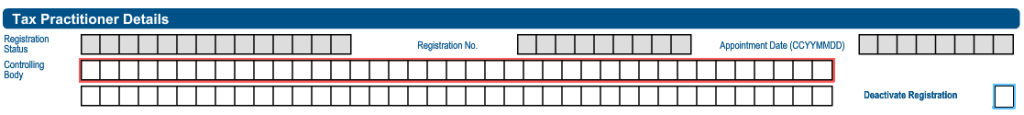

Select the “My tax practitioner details” tab and the tax practitioner details container will be displayed with the following fields:

- Registration Status – Registered or Unregistered

- Registration Number

- Appointment Date (CCYYMMDD) – indicates the date the tax practitioner was officially registered as a tax practitioner.

- Controlling Body

- Deactivate Registration

![]()

If you select the Controlling body field, a list of Controlling Bodies will be displayed to select from. Tax Practitioners that have not registered with a Recognised Controlling Body (RCB) or that have registered with the RCB but the RCB has not submitted the information to SARS; will be able to select one RCB from a list of 11 Recognised Controlling Bodies. This information will be submitted to SARS but it does not mean that the tax practitioner is registered with the RCB as well. The tax practitioner still needs to register with the RCB.

Top tip: The tax practitioner’s status will only reflect as “Registered” on SARS systems once the RCB and the practitioner have successfully submitted information to SARS and the details match.

Click the “Ok” button to continue or “Cancel” to go back to the form. The screen below is only an example of the Controlling Bodies screen that will be displayed in the instance where a tax practitioner is registered with more than one RCB and the RCB has submitted all relevant information to SARS.

After you have selected the Controlling Body, select the “Done” button on the RAV01 page to proceed.

![]()

The Controlling Body information will be populated onto the form.

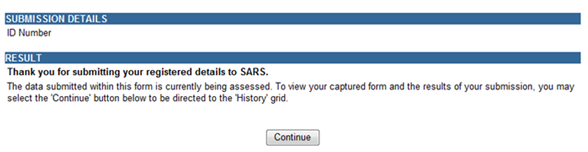

Select the “Edit” button to edit the RAV01 form. The “Save” button will save the changed you have made to the form and you will be able to submit the form at a later stage. If you select “Cancel”, you will return to the previous page. Select the “File” button to submit the RAV01 form to SARS. After you have submitted the RAV01 form, you will receive the following message, select “Continue”:

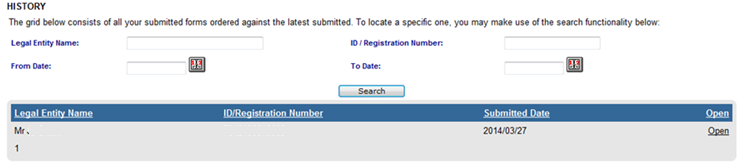

History

In order to view all submitted RAV 01 forms, select the “Organisation” tab, “SARS Registered Details” menu and “History”.

Select the “Open” hyperlink to view the RAV01 form.

Deactivate Registration of Tax Practitioner on eFiling

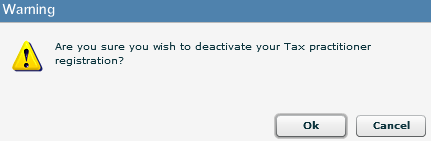

This functionality will only deactivate the registration of the tax practitioner, which means that you will not be able to practice as a tax practitioner nor be assisted by SARS through any of the tax practitioner channels. In the tax practitioner container on the RAV01 form, there is a tick box that may be selected if you wish to deactivate your tax practitioner registration.

A warning message will be displayed to ensure that you want to deactivate the registration.

Select “Ok” to continue or “Cancel” if you do not want to deactivate the registration. If you click “Ok”, the tick box will be selected.![]()

You will receive a Deregistration notice, that you can view by following the steps in the section below “Tax Practitioner Notices”.

Note: If you select to deactivate your registration, you will not be able to assist any taxpayer in your capacity as a registered tax practitioner. You will still be allowed to act as a representative on behalf of others provided the service is not for payment.

Now that you are registered on eFiling, you will need to add you clients to your eFiling profile.