On this page, you will find:

- Determine RFI’s

- Review of RFI’s

- Identification of RFI’s

- Due diligence and reporting of RFI’s

- Reporting by RFI’s

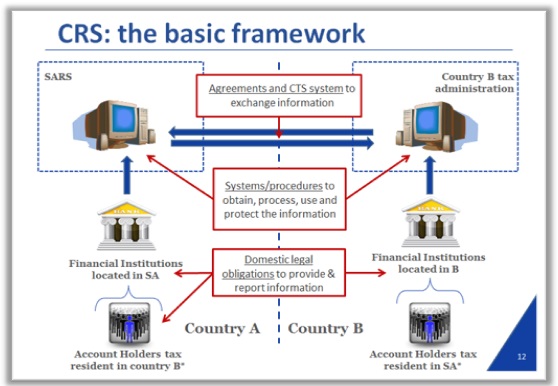

Common Reporting Standard (CRS) obligations are imposed on South African financial institutions. The CRS Regulations were issued under the Tax Administration Act, 2011 (TAA). SARS has also published a FAQ Guide on the CRS. The CRS implementing legislation requires that the model CRS must be applied consistently with the Organisation for Economic Cooperation and Development (OECD) CRS Commentary. The following additional information is made available by the OECD:

- The OECD also maintains and regularly updates a list of CRS Frequently Asked Questions. These FAQs were received from business and government delegates and answers to such questions clarify the CRS and assist in ensuring consistency in implementation.

- In addition to the CRS, the OECD has published a CRS Implementation Handbook, which, although not part of the CRS, provides a practical guide to implementing the CRS to both government officials and financial institutions and includes a comparison between the CRS and FATCA.

- The CRS by jurisdiction table contains a comprehensive overview of the legislation, regulations and guidance that jurisdictions have developed for the purpose of implementing the CRS.

- Jurisdictions have made information available with respect to their Tax Identification Numbers (TINs) and tax residency rules, in order to help both taxpayers and financial institutions to comply with their obligations under the CRS.

How does CRS in SA work:

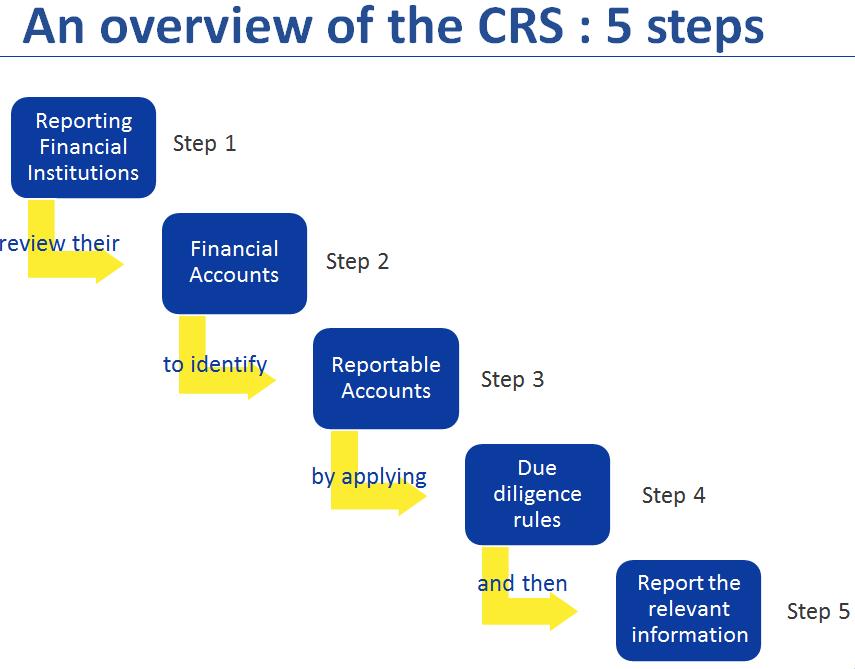

The CRS has five steps:

STEP 1: DETERMINE REPORTING FINANCIAL INSTITUTIONS

Financial Institutions residents in SA (referred to as Reporting Financial Institutions or RFIs) that must apply the prescribed due diligence requirements to find reportable accounts and report the prescribed information, include any Financial Entity (whether a legal entity or legal arrangement such as a trust or partnership) that is a Custodial Institution, a Depository Institution, an Investment Entity, or a Specified Insurance Company. Certain Financial Institutions or financial accounts are specifically excluded under the CRS. The CRS Regulations gives a general description of excluded FIs or accounts. Specific exclusions are listed in Annex 1 and Annex 2 to the regulations.

What is a Reporting Financial Institution:

Step 1.1 What is an Entity?

An Entity is a legal entity such as a company or a legal arrangement such as a trust or partnership. Even though a trust is not considered an entity under SA common law, it is treated as an entity for AEOI purposes.

Step 1.2 What is a Participating Jurisdiction?

A Participating Jurisdiction, broadly, is a country where the CRS is domestic law and which has agreements in place with other CRS participating countries to automatically exchange CRS information.

Step 1.3 What is a Financial Institution?

| Type | Characteristics |

| Depository Institutions |

|

| Custodial Institutions |

|

| Investment Entities |

|

| Specified Insurance Companies |

|

Please note: A nil return must be filed by an RFI that did not maintain any reportable accounts during the relevant reporting period.

Step 1.4 What are Non-Reporting Financial Institutions?

| CRS Regulations exclusions (Section VIII(B)) | Low risk excluded FIs under Annex 1 to the CRS Regulations |

|

|

STEP 2: REVIEW FINANCIAL ACCOUNTS

Step 2.1 Which Financial Accounts must be reviewed? A financial account is an account maintained by a Financial Institution. Specifically, the term ‘Financial Account’ includes five categories of accounts: Depository Accounts, Custodial Accounts, equity and debt interests, Cash Value Insurance Contracts and Annuity Contracts as set out below:

| Account | The Financial Institution generally considered to maintain it |

| Depository Institutions | • The Financial Institution obliged to make payments with respect to the account. |

| Custodial Institutions | • The Financial Institution that holds custody over the assets in the account. |

| Investment Entities | • The interests in an Investment Entity (or other Financial Institution – anti-avoidance) are “maintained” by that Investment Entity (or other Financial Institution). |

| Cash Value Insurance/ Annuity Contracts | • The Financial Institution obliged to make payments with respect to the contract. |

The term “Equity Interest” means, in the case of a partnership that is a financial institution, either a capital or profits interest in the partnership. In the case of a trust that is a financial institution, an equity interest is considered to be held by any person treated as a settlor or beneficiary of all or a portion of the trust, or any other natural person exercising ultimate effective control over the trust.

Step 2.2 Which Financial Accounts are excluded?

Some types of accounts are excluded from being Financial Accounts and so are not subject to the due diligence and reporting obligations. Under the CRS these are called Excluded Accounts. There are two categories of excluded accounts, i.e. those excluded under the Standard (described in Section VIII(C)(17) of the CRS Regulations) and those excluded by each CRS participating jurisdiction based on certain criteria such as if the account type is a low risk for being used for tax evasion. South Africa’s specific excluded accounts are reflected in Annex 2 to the CRS Regulations:

| CRS Excluded Accounts | SA Specific Excluded Accounts |

|

|

Step 2.3 Which financial assets are included by the CRS?

Financial accounts that may be reportable accounts under the CRS are accounts that maintain financial assets such as:

- Security (for example, a share of stock in a corporation; partnership or beneficial ownership interest in a widely held or publicly traded partnership or trust; note, bond, debenture, or other evidence of indebtedness).

- Partnership interest.

- Commodity.

- Swap (for example, interest rate swaps, currency swaps, basis swaps, interest rate caps, interest rate floors, commodity swaps, equity swaps, equity index swaps, and similar agreements).

- Insurance Contract.

- Annuity Contract.

- Any interest (including a futures or forward contract or option) in a security, partnership interest, commodity, swap, Insurance Contract, or Annuity Contract.

The term “Financial Asset” does not include a non-debt, direct interest in real property. See the differences between FATCA and CRS.

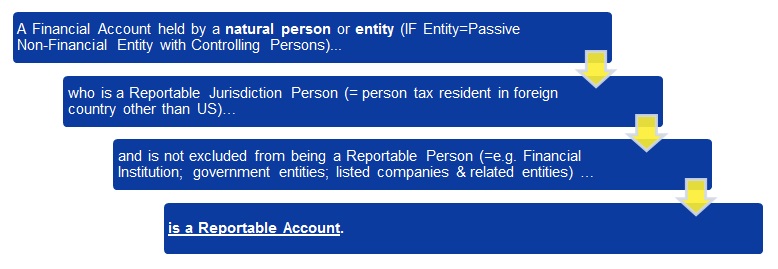

STEP 3: IDENTIFY REPORTABLE ACCOUNTS

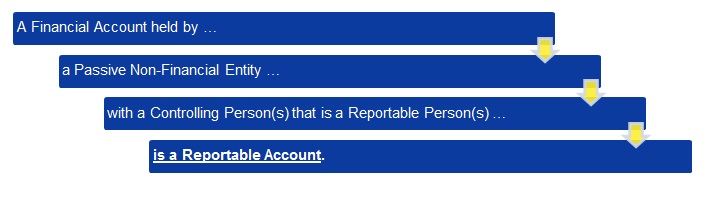

Step 3.1 What is a Reportable Account?

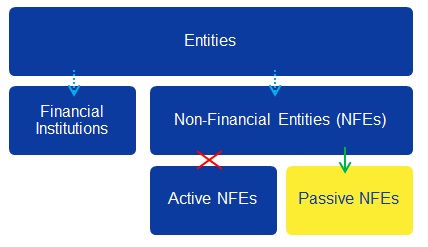

Step 3.2 What is a Passive Non-Financial Entity?

A Passive NFE is an Entity that is not an Active NFE.

The CRS does not require the review and reporting of financial accounts held by Active NFE, which include for example NFEs that meet the criteria listed in Section VIII(D)(9) of the CRS Regulations.

Step 3.3 Who are Controlling Persons of a PNFE?

To determine who is the controlling person or beneficial owner of a PNFE, the Financial Institution must “look through” the Entity to identify the natural person(s) who exercises control over the Entity (generally controlling ownership interest in the Entity, which is often interpreted ≥ 25% ownership). For trusts (and equivalents), the Controlling Persons are the settlor(s), trustee(s), protector(s), beneficiary(ies) and any other natural person(s) exercising effective control over the trust.

STEP 4: RFIs MUST APPLY DUE DILIGENCE RULES TO IDENTIFY REPORTABLE ACCOUNTS

Step 4.1 What are the general due diligence obligations of RFIs?

The AEOI due diligence procedures are the procedures an RFI is required to undertake to determine whether there are any Reportable Accounts among the Financial Accounts it maintains. For the CRS, the general due diligence procedures that SA RFIs must comply with are described in Sections II to VII of the CRS Regulations, as interpreted by the CRS Commentary. RFIs are required to establish whether a person holding the account is tax resident in any foreign jurisdiction. In addition, RFIs have further due diligence obligations for entity account holders. Identifying the account holder is a key requirement of the due diligence procedures. In most cases, identifying the holder of a financial account is straightforward and the account holder is the person listed or identified by the RFI who maintains the account as the holder of the account. However, RFIs must consider the type of account and the capacity in which it is held. ‘Account Holder’ is defined in the AEOI regimes such that where a person, other than a financial institution, holds a financial account for the benefit or account of another person as an agent, custodian, nominee, signatory, investment adviser or intermediary, then that other person is the account holder. An RFI may rely on information in its possession (including information collected in line with AML/KYC procedures), based on which it can reasonably determine if a person is acting for the benefit or account of another person.

Step 4.2 How must RFIs determine the controlling person/beneficial owner of an entity account?

The due diligence procedures in the AEOI regimes are generally aimed at determining whether the account holder is a reportable person, or has a controlling person who is a reportable person in the case of passive NFEs, so that the RFI can report the respective accounts to SARS as a reportable account. A controlling person is defined in the CRS Regulations and means the natural persons who exercise control over an entity. In the case of a trust, the following persons are all regarded as the controlling persons of the trust:

- Settlor.

- Trustee.

- Protector (if any).

- Beneficiary or a class of beneficiaries.

- Any other natural person exercising ultimate effective control over the trust.

In the case of a legal arrangement other than a trust, such as a partnership, the controlling persons are the persons in equivalent or similar positions to those of a trust. Very importantly, the CRS Regulations requires that RFIs must interpret the term “controlling persons” in a manner consistent with the 2012 Financial Action Task Force (FATF) recommendations aimed to identify the beneficial owners of a legal entity. FATF is an independent international inter-governmental body that develops and promotes policies to protect the global financial system against money laundering and terrorist financing. The FATF Recommendations are recognised as the global anti-money laundering (AML) and counter-terrorist financing (CFT) standard. South Africa is a member of FATF and must give effect to these recommendations, which has now been done in the Financial Intelligence Centre Act, 2001, as amended in 2017 for this purpose (“the new FICA”). Although the CRS Regulations use the term controlling person, it essentially corresponds to the beneficial owner. Accordingly, from 1 March 2016 when the CRS Regulations commenced, RFIs are required in the circumstances prescribed by the CRS Regulations, to identify the natural controlling person/beneficial owner of entity account holders in a manner consistent with the 2012 FATF recommendations and, once the new FICA commences, in a manner consistent with the new FICA. AML/KYC procedures (Anti-money-laundering and Know-your-client) are an integral part of the due diligence procedures for the AEOI regimes and determining the controlling persons/beneficial owners of entities. In South Africa, the obligation to obtain AML/KYC information from account holders is imposed under FICA on ‘accountable institutions’. Most RFIs essentially are ‘accountable institutions’ for FICA purposes. The old FICA (before its amendment in 2017) required RFIs to identify and verify the identity of a client and, if the client is acting on behalf of someone else or someone else is acting on behalf of client, to identify and verify the identity of that person or client. Without the completion of the identification and verification process, RFIs may not transact with the client. In the context of a financial account this means the account may not be opened for or, if already opened when the old FICA came into effect, used by the client. Under the new FICA, RFIs are obliged to determine the identity of the beneficial owner of an account held or opened by a legal person. Beneficial owner means a natural person who, independently or together with another person, directly or indirectly:

- Owns the legal person, or

- Exercises effective control of the legal person.

The process to establish the identity of the beneficial owner of the client under the new FICA requires three steps:

- Determining the identity of each natural person who, independently or together with another person, has a controlling ownership interest in the legal person;

- If in doubt whether the above natural person is the beneficial owner of the legal person or no natural person has a controlling ownership interest in the legal person, determining the identity of each natural person who exercises control of that legal person through other means; or

- If a natural person who exercises control is not identified, determining the identity of each natural person who exercises control over the management of the legal person, including in his or her capacity as executive officer.

Thereafter, accountable institutions must take reasonable steps to verify the identity of the beneficial owner of client. For some identification tasks an RFI may rely solely on information collected and maintained through properly conducted AML/KYC procedures, for other tasks the review of information must cover the AML/KYC information and any other information held on the client. An RFI may rely solely on their AML/KYC procedures when:

- Reasonably determining that an entity is an Active NFE or a Financial Institution (any entity account)

- Identifying the controlling persons of an entity (any entity account, but note the procedures relating to settlors of trusts)

- Determining whether the Controlling Person or persons of a Passive NFE holding a Pre-existing Account is a Reportable Person, provided that the balance or value does not exceed $1 million.

An RFI must review AML/KYC information and any other information held on the client when:

- Confirming the reasonableness of a self-certification for a New Individual Account or a New Entity Account

- Determining whether the holder of a Pre-existing Entity Account may be a Reportable Person.

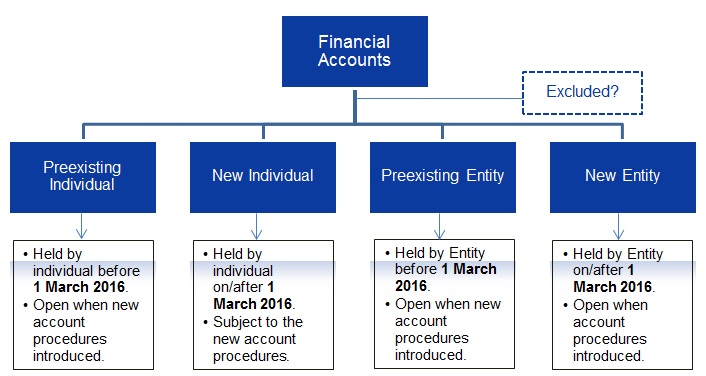

The details of due diligence requirements depend on whether an account is pre-existing or a new account. An account is pre-existing if it is in existence as of 29 February 2016 for the CRS, or was in existence on 30 June 2014 for FATCA. The required due diligence further depends on whether an account holder is an individual or an entity. For accounts held by individuals, there are further distinctions in procedures for Lower Value Accounts and High Value Accounts (CRS and FATCA) or below a threshold (FATCA).

Step 4.3 Which accounts must a Financial Institution review?

For Preexisting Individual Accounts, New Individual Accounts and New Entity Accounts, no de minimis threshold applies. In respect of Preexisting Entity Accounts, the CRS Regulations allows the application of the USD 250,000 (or the Rand equivalent based on an exchange rate of R15 to US$1) threshold meaning accounts below this amount are not reportable and subject to review, unless the RFI elects otherwise.

Step 4.4 How must RFIs review individual accounts?

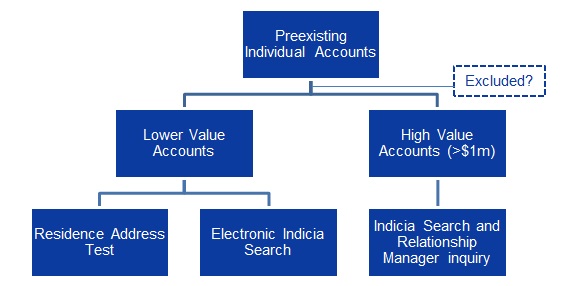

A. Preexisting individual lower value accounts

A Lower Value Account for CRS purposes is an individual account with an aggregate balance or value that does not exceed $1 million as of 29 February 2016. It will remain a lower value account as long as the balance or value does not exceed $1 million last day of February 2017 and last day of February of subsequent years. An RFI can apply either a residence address test or an electronic record search.

- Residence address test: The current residence address for these purposes is the residential address recorded by the RFI for the Account Holder. A residential address is one where the RFI understands or presumes the account holder resides. A ‘care of’ or post office box address would not generally be presumed to be the residential address (except in special circumstances such as that of military personnel). The current residence address must be substantiated by evidence, such as:

- Documentary Evidence, i.e. the evidence specified in Section VIII(E)(6) of the CRS Regulations Broadly, it covers certain documents issued by an authorised government body, an audited financial statement, third party credit report, bankruptcy filing or securities regulator’s report

- Supporting documentation, such as a document issued by an authorised government body or a utility company

- General documentation, i.e. any of the above, and any other government or formal commercial document such as, for example, a trust deed or company certificate.

- Electronic records search: Where an RFI is unable to establish the residence of an individual with a Lower Value Account with the residence address test, or chooses not to apply the residence address test, it must review its electronically searchable data for indicia of the individual’s residence. The account holder is regarded as a resident of a foreign jurisdiction if any of the following foreign indicia is found:

- The account holder is identified as resident of a foreign jurisdiction or as a US citizen

- A current mailing or residence address (including a post office box) of the account holder is in a foreign jurisdiction

- There are one or more current telephone numbers in a foreign jurisdiction and no telephone number for the account holder in South Africa

- For non-depository accounts only, that there are current standing instructions to transfer funds to an account maintained in a foreign jurisdiction

- There is a currently effective power of attorney or signatory authority granted to a person with an address in a foreign jurisdiction

- An ‘in-care-of’ address or ‘hold mail’ instruction in a foreign jurisdiction if the RFI does not have any other address on file for the account holder.

If none of these indicia are discovered through an electronic search, no further action is required for lower value accounts unless and until there is a subsequent change of circumstance that results in one or more of these indicia being associated with the account or the account holder, or the account becomes a high value account. Where any of the first four indicia are found or subsequently arise the account becomes a reportable account unless the RFI takes action that leads to the indicia being cured. The RFI may (but is not required to) cure the indicia by obtaining both:

- A self-certification (if not already obtained); and

- Documentary Evidence supporting the self-certification to establish the account holder’s non-reportable status.

In the case where the only indicium is item 6 above (an ‘in-care-of’ address or ‘hold mail’ instruction in a foreign jurisdiction and no other address on file for the Account Holder), the RFI is required to undertake at least one of these actions:

- Conduct a paper record search of certain documents specified in the CRS; or

- Seek a self-certification or documentary evidence from the account holder to establish their tax residency.

If the paper record search action is chosen and further foreign indicia are found, the account is a reportable account unless the RFI takes the appropriate curing action for the indicia. If the paper record search finds an South African address and no other foreign indicia are found, the account is not a Reportable Account. For any of these curing procedures in which Documentary Evidence is obtained, the evidence will be sufficient to confirm non-reportable status for CRS purposes (but not FATCA) if it contains a current South African residential address. If the chosen course of action fails to resolve the status of the account the RFI is required to attempt the other course of action. If neither course of action is successful in resolving the status of the account, the RFI must report the account as an undocumented account. If foreign residence indicia were found and not remediated (“cured”) under the options available, the account is a Reportable Account for the indicated jurisdiction(s). The RFI maintaining the account must make reasonable efforts to obtain the account holder’s date of birth and Taxpayer Identification Number (TIN) if these are not already held. An RFI must monitor the balance of lower value pre-existing individual accounts on the last day of February of each year from 2017. On the first occasion the balance exceeds $1 million, the account becomes a high value account and the RFI must carry out the enhanced review procedures for High Value accounts in the next calendar year.

B. Preexisting individual high value accounts

For CRS purposes, a High Value Account is an individual account with an aggregate balance or value that exceeds $1 million on last day of February 2017 and last day of February of subsequent years. The RFI must, for both the CRS and FATCA, start with an electronic record search and then continue, where appropriate, with a paper record search and a relationship manager inquiry.

- The electronic record search for CRS is a search for the same indicia as described for lower value accounts. If the RFI’s electronically searchable databases include fields for the indicia included in the electronic record search, and capture all of the information described in those fields, a paper record search is not required for the CRS

- The paper record search for indicia should include a review of the current master file and, to the extent that they are not contained in the current master file, the following documents associated with the account and obtained by the Financial Institution within the last 5 years:

- The most recent Documentary Evidence collected with respect to the account

- The most recent account opening contract or documentation

- The most recent documentation obtained by the Financial Institution for AML/KYC procedures or other regulatory purposes

- Any power of attorney or signatory authority currently in effect

- Any standing instructions to transfer funds currently in effect (in the case of the CRS, instructions for a Depository Account is not a potential indicium).

- A relationship manager inquiry is always required for high value accounts if the account or any account aggregated with it has such a manager.

The relationship manager inquiry is in addition to the electronic record search and (if appropriate) the paper record search. The RFI must consider whether any relationship manager associated with the account or any accounts aggregated with such an account has actual knowledge that would identify the Account Holder as a Reportable Person. A relationship manager is an employee or officer of the RFI who has been assigned responsibility for specific Account Holders on an ongoing basis. A person with some contact with Account Holders, but whose functions are of a back office, administrative or clerical nature, is not considered to be a relationship manager. The effect of finding indicia is the same as for lower value individual accounts, namely:

- If none of the relevant indicia are found in the review of the high value account and there is no relationship manager with actual knowledge that the account holder is a reportable person, no further action is required until there is a change in circumstances resulting in one or more indicia being associated with the account

- In the special case where the only indicium is an ‘in-care-of’ address or ‘hold mail’ instruction in a foreign jurisdiction and there is no other address on file for the Account Holder, the RFI must obtain a self-certification or Documentary Evidence from the account holder to establish their tax residency. If the RFI cannot obtain either of these, it must report the account as an undocumented account

- An RFI may cure certain indicia if it obtains or has previously obtained and recorded a self-certification and documentary evidence that establishes the Account Holder’s status as non-reportable.

C. New individual accounts New individual accounts are accounts that are opened on or after 1 March 2016. The Financial Institution must:

- Obtain a self-certification: Upon account opening, obtain a valid self-certification establishing tax residency from the individual seeking to open an account. A self-certification must be signed/positively affirmed, dated and include the following:

- Name

- Residence address

- Date of birth

- Jurisdiction(s) of residence for tax purposes

- Taxpayer Identification Number (TIN) – in South Africa it would be the individual’s income tax reference number

- Verify the self-certification: The FI must compare the self-certification to the other information obtained in connection with the account opening (including for AML/KYC obtained under FICA) to determine if it is valid. If the self-certification conflicts with other information that the FI has or is otherwise unreliable, the FI must either obtain a new self-certification or a reasonable explanation from the individual supported by documentary evidence.

Self-certification: A self-certification may be provided in any manner and in any form – see for example the sample self-certification forms by the OECD. Provided the self-certification contains all the required information and the self-certification is signed or positively affirmed by the customer, an RFI may gather verbally the information required to populate or otherwise obtain the self- certification. The approach taken by an RFI in obtaining the self-certification is expected to be in a manner consistent with the procedures followed by the RFI for the opening of the account. The RFI will need to maintain a record of this process for audit purposes, in addition to the self- certification itself. In all cases, the positive affirmation is expected to be captured by the RFI in a manner such that it can credibly demonstrate that the self-certification was positively affirmed (e.g. voice recording, digital footprint, etc.). A self-certification can be completed based on a yes/no response to record the client’s jurisdiction of tax residence, instead of requiring the completion of a blank field. For example, in order to complete a self- certification the client could be asked whether the jurisdiction in which the account is being opened is the sole tax residence of the account holder, with additional questions only being asked if the answer is no. If the self-certification establishes that the Account Holder is a foreign tax resident, the RFI must treat the account as a Reportable Account. An account holder may be a tax resident of more than one jurisdiction. Even if no CRS reporting is required, a record of the self-certification must be kept for record purposes.

Timing of the self-certification:

Please note: A Reporting Financial Institution must obtain a self-certification upon account opening. Where a self-certification is obtained at account opening but validation of the self-certification cannot be completed because it is a ‘day two’ process undertaken by a back-office function, the self-certification should be validated within a period of 90 days.

There are a limited number of instances, where due to the specificities of a business sector it is not possible to obtain a self-certification on ‘day one’ of the account opening process, for example where an insurance contract has been assigned from one person to another or in the case where an investor acquires shares in an investment trust on the secondary market. In such circumstances, the self- certification should be both obtained and validated as quickly as feasible, and in any case within a period of 90 days. If the self-certification does not require CRS reporting it must still be obtained and kept for record purposes.

It is recognised that an RFI may be unable to obtain the self-certification for all accounts within the 90 day period in exceptional circumstances, for example due to system constraints in the first year of reporting. In such cases the RFI may approach SARS to determine a method of dealing with such circumstances to ensure that it is able to comply with its due diligence obligation to obtain self-certifications for all new accounts, which may include a risk based approach to prioritisation.

Measure to enforce the provision of self-certifications upon account opening:

Given that obtaining a self-certification for new accounts is a critical aspect of ensuring that the CRS is effective, it is expected that South Africa have strong measures in place to ensure that valid self-certifications are always obtained for new accounts (see examples in paragraph 18 of the OECD CRS Commentary on Section IX). In all cases, Reporting Financial Institutions must ensure that they have obtained and validated the self-certification in time to be able to meet their due diligence and reporting obligations with respect to the reporting period during which the account was opened. Therefore, a self-certification must be obtained by an RFI upon account opening unless the limited number of instances or exceptional circumstances set out above apply.

SARS is of the view that not allowing a person who presents indicators of being a reportable person to transact on an account until a valid self-certification is obtained, will ensure compliance by the RFI with its due diligence obligations under the CRS Regulations to obtain self-certifications and minimise the risk of being sanctioned for failing to determine and report a reportable account. This approach is supported by:

- The wording of Section IV(A) and VI(A) of the CRS Regulations read with the OECD CRS Frequently Asked Questions (Question 22 on page 10), and

- The fact that the failure by an RFI to so obtain a self-certification and the failure by the client to provide the self-certification is enforced by the sanctioning of such non-compliance under Public Notice 193.

If the client who wants to open an account refuses, without just cause to provide the self-certification or other documents required under the CRS by the FI, it constitutes non-compliance by the client under Public Notice 193 read with section 26 of the TAA and Section X(A)(2) of the CRS Regulations and the client may incur an administrative penalty imposed by SARS. For more information on sanctions, see SARS AEOI Penalties.

Step 4.5 How must Entity accounts be reviewed?A. Preexisting Entity accounts

A preexisting entity account is an account exceeding US $250,000 held by an entity (a non-individual) on 1 March 2016. The RFI must review the aggregated account balance at the end of February each year to determine if the balance has exceeded the threshold on that date. Once the balance has exceeded $250,000 at the review date, the account becomes reviewable and due diligence must be carried out in the following 12 months.

If an RFI is required to carry out due diligence on an entity account, it must follow these procedures to determine if the account is held by one or more entities that are Reportable Persons. The RFI must also establish whether an entity is a Passive NFE or should be treated as a PNFE and if so, “look through” the entity account holder to the controlling persons to determine whether they are reportable persons.

- Account holder is a reportable person

An RFI must review information maintained for regulatory or customer relationship purposes (including information collected for AML/KYC purposes) to determine whether the Account Holder is resident of a foreign jurisdiction. Information indicating that the Account Holder is resident in a foreign jurisdiction includes:

- A place of incorporation or organisation in a foreign jurisdiction

- An address in a foreign jurisdiction.

If the information indicates that the account holder is a foreign resident, the RFI must treat the account as a reportable account unless, at the RFI’s option, it cures this status by:

- Obtaining a self-certification to the contrary from the account holder (signed by a person with authority to sign on behalf of the entity), or

- Reasonably determining based on information in its possession or publicly available that the account holder is not a reportable person (for example, where such information shows that the entity is a listed public company or a governmental entity

2. Account holder is a RFI If an account holder is an RFI the account would generally not be a reportable account for CRS purposes unless the RFI is a type B Investment Entity (see below) and is resident in a jurisdiction that is not a CRS participating jurisdictions, in which case the RFI is deemed to be a Passive NFE.

Broadly, under the CRS Regulations an entity is an Investment Entity if it:

- Primarily conducts as a business specified activities for or on behalf of customers (‘type A’), or

- Primarily derives its gross income from investing or trading in Financial Assets and is managed by a Financial Institution (‘type B’).

An entity is a type B Investment Entity if it is:

- Investing on its own account, as a collective investment vehicle on behalf of participants or as a trust on behalf of beneficiaries, and

- Managed by a Depository Institution, a Custodial Institution, a Specified Insurance Company or a type A Investment Entity mentioned above, and it meets the Financial Assets test described below.

An entity is managed by a Financial Institution if that Financial Institution performs, either directly or through another service provider, any of the investing or trading activities described above on behalf of the entity. The activities may be performed as part of managing the entity as a whole, or by appointment to manage all or a portion of the Financial Assets of the entity. An entity is not regarded as being managed by a Financial Institution if that Financial Institution does not have discretionary authority to manage the entity’s assets.An entity meets the Financial Assets test if its gross income is primarily attributable to investing, reinvesting or trading in Financial Assets – at least 50% of its income is attributable to investing, reinvesting or trading in Financial Assets in the shorter period of either the:

- Three-years ending on the last day of February in the year before that when its status as an investment entity is to be determined , or

- Time the entity has existed.

3. Passive NFE controlling persons3. Passive NFE controlling persons

The RFI must determine whether the entity is a Passive NFE. If so, the RFI must identify the controlling persons of the Passive NFE and whether any of those controlling persons is a reportable person. For the purposes of determining whether the entity is a Passive NFE, the RFI must request a self-certification unless it has information in its possession or that is publicly available to reasonably determine the status of the Account Holder. To identify the controlling persons, the RFI may rely on information collected and maintained in line with AML/KYC procedures. If the Passive NFE account holder is a legal person (for example, a company), a natural person is treated as a controlling person if they meet the AML/KYC threshold for ultimate beneficial ownership. If no natural person meets the threshold, the controlling person will be the person who holds the position of senior managing official for the entity. If a controlling person of the Passive NFE is itself an entity, the RFI will need to identify the natural persons that control that entity (and so on, if there is a chain of entities, until the ultimate natural persons with control are determined). If the account balance or value does not exceed $1 million, the RFI may also rely on information collected and maintained in line with AML/KYC procedures to determine if any of the controlling persons are reportable persons. The process to identify whether a controlling person is a reportable person is a search for indicia as described for individuals above. The same curing options are also available as described for individuals. If the account balance or value does exceed $1 million, the RFI must seek a self-certification from either the account holder or the controlling person to establish whether any of the controlling persons are reportable persons. This may be provided in the same self-certification provided by the account holder to determine its own status. If a self-certification is required but is not received after reasonable efforts to obtain it, the RFI must then rely on an electronic record search for indicia to determine whether any controlling persons are reportable persons. The electronic record search is that as described for individuals. If no indicia are present, no further action is required until there is a change in circumstances that results in foreign tax residence indicia for a controlling person linked to the account.

B. New entity accounts

There is no minimum threshold for due diligence on new entity accounts under the CRS – all new entity accounts must be reviewed. For a new entity account, the RFI must determine whether the account is held by one or more entities that are reportable persons. The RFI must also establish whether an entity is a Passive NFE or should be treated as a Passive NFE and if so, “look through” the entity account holder to the controlling persons to determine whether they are reportable persons.

- Account holder is a reportable person

In order to determine whether an entity account holder is a reportable person, the RFI must generally obtain a self-certification in the account opening procedure. It must also confirm the reasonableness of the self-certification based on information obtained in connection with the account opening. If the self-certification indicates that the account holder is resident in a foreign jurisdiction, the RFI must treat the account as a reportable account. A self-certification is not required where the RFI reasonably determines, based on information in its possession or publicly available, that the account holder is clearly not a reportable person.

2. Account holder is a RFIIf an account holder is an RFI the account would generally not be a reportable account for CRS purposes unless the RFI is a type B Investment Entity (see below) and is resident in a jurisdiction that is not a CRS participating jurisdictions, in which case the RFI is deemed to be a Passive NFE. Broadly, under the CRS Regulations an entity is an Investment Entity if it:

- Primarily conducts as a business specified activities for or on behalf of customers (‘type A’); or

- Primarily derives its gross income from investing or trading in Financial Assets and is managed by a Financial Institution (‘type B’).

An entity is a type B Investment Entity if it is:

- Investing on its own account, as a collective investment vehicle on behalf of participants or as a trust on behalf of beneficiaries, and

- Managed by a Depository Institution, a Custodial Institution, a Specified Insurance Company or a type A Investment Entity mentioned above, and it meets the Financial Assets test described below.

An entity is managed by a Financial Institution if that Financial Institution performs, either directly or through another service provider, any of the investing or trading activities described above on behalf of the entity. The activities may be performed as part of managing the entity as a whole, or by appointment to manage all or a portion of the Financial Assets of the entity. An entity is not regarded as being managed by a Financial Institution if that Financial Institution does not have discretionary authority to manage the entity’s assets.

An entity meets the Financial Assets test if its gross income is primarily attributable to investing, reinvesting or trading in Financial Assets – at least 50% of its income is attributable to investing, reinvesting or trading in Financial Assets in the shorter period of either the:

- Three-years ending on the last day of February in the year before that when its status as an investment entity is to be determined, or

- Time the entity has existed.

3. Passive NFE controlling personsThe RFI must determine whether the entity is a Passive NFE. If so, the RFI must identify the controlling persons of the Passive NFE and whether any of those controlling persons is a reportable person. For the purposes of determining whether the entity is a Passive NFE, the RFI must request a self-certification unless it has information in its possession or that is publicly available so it can reasonably determine the status of the Account Holder. To identify the controlling persons, the RFI may generally rely on information collected and maintained in line with AML/KYC procedures. These procedures must be consistent with recommendations 10 and 25 of the 2012 FATF Recommendations or the new FICA, including always treating the settlors and beneficiaries of a trust as controlling persons. If the Passive NFE Account Holder is a legal person (for example, a company), a natural person is treated as a controlling person if they meet the AML/KYC threshold for ultimate beneficial ownership. If no natural person meets the threshold, the Controlling Person will be the person who holds the position of senior managing official for the entity. If a controlling person of the Passive NFE is itself an entity, the RFI will need to identify the natural persons that control that entity (and so on, if there is a chain of entities, until the ultimate natural persons with control are determined). The RFI must seek a self-certification from either the account holder or the controlling person to establish if any controlling persons are reportable persons. This may be provided in the same self-certification as that provided by the account holder to determine its own status. As a self-certification is required to establish the status of the controlling persons, this may be an opportune time to request or confirm the identity of the controlling persons (even though the RFI could solely rely on AML/KYC information for that purpose and procedures consistent with the 2012 FATF Recommendations or the new FICA).

Step 4.6 How must RFIs obtain and verify taxpayer identification numbers (TINs)

For both new and pre-existing accounts, a TIN is not required if a TIN was not issued to the person by the relevant jurisdiction. Such a circumstance can arise because either:

- TINs are not used by the jurisdiction (see the OECD’s Tax Identification Numbers); or

- TINs are used in the jurisdiction, but the particular person, for a range of possible reasons, has not obtained or been issued a TIN for that jurisdiction.

RFIs are not required to verify the accuracy of the TIN of an account holder under the CRS Regulations or the BRS. The following is, however, required:

- Preexisting Accounts: An RFI is required to use reasonable efforts to obtain the TIN(s) of a pre-existing account holder. If no TIN is found after due diligence that meets the “reasonableness test”, none needs to provided. Also, the TIN is not required to be reported if (i) a TIN is not issued by the relevant Reportable Jurisdiction, or (ii) the domestic law of the relevant Reportable Jurisdiction does not require the collection of the TIN issued by such Reportable Jurisdiction.

- New Individual Accounts: If the self-certification establishes that the Account Holder is resident for tax purposes in a Reportable Jurisdiction, the RFI must treat the account as a Reportable Account and the self-certification must also include the Account Holder’s TIN with respect to such Reportable Jurisdiction (subject to Section I.D).

If a person claims not to have a TIN, this statement should be part of the self-certification collected for the account, unless the RFI reasonably determines that the person would not have a TIN for the relevant foreign jurisdiction, based on information on the OECD’s Tax Identification Numbers. In exceptional circumstances the customer may declare to be a foreign tax resident but not provide their TIN, because they need additional time to locate the TIN (for example, the customer is an exchange student whose TIN has always been solely in the possession of the student’s parents, who reside overseas). In such exceptional cases, an RFI should obtain the missing TIN within a reasonable period of time, in no cases exceeding 90 days. The account should not proceed if after this period of time the person seeking the account cannot or refuses to provide the TIN.

Step 4.7 What is a change in circumstances?

A change in circumstances relating to an account or information held by the RFI for an account is a change that results in new or additional information relevant to the status of the account for reporting purposes. It includes an addition or change of an account holder. A change in circumstances for an account must be considered for all accounts maintained by the RFI for the account holder to the extent computerised systems allow aggregation of the accounts. An RFI is expected to have procedures that ensure a change in circumstances is identified by the RFI. These procedures should cover information that comes to a relationship manager of a high value account (if there is one). RFIs should encourage any persons providing a self-certification to notify the RFI of a change in circumstances affecting the validity of the self-certification. A change in circumstances may require the RFI to report the account or to take action to resolve the status of the account. Where a change in circumstances has caused an RFI to know or have reason to know that a self-certification or other documentation used in the original due diligence for the account is unreliable, the RFI must re-determine the status of the account. The re-determination process broadly follows the original due diligence process for the account.

For more information:

- AEOI homepage

- Differences between FATCA and CRS?

- How does FATCA reporting work?

- AEOI Administrative penalties

Need more help?

Should you need more help, please send an email to 3rd Party Data Support: Bus_Sys_CDSupport@sars.gov.za.