Here is a very simple guide to how much tax you will have to pay and when. We’ll also show you what you must do and how you must do it.

How much?

It’s simple you pay tax when you begin to earn income of more than the agreed amount that year and you pay it all your working life up to the age of 65. This tax is worked out on a sliding scale, see this scales in the latest documents below.

And when?

Tax works in tax years. The year starts 1st March and ends 28th February. (Except of course in a leap year when it will be 29th February). You need to submit a return in Filing Season. See our Tax Calendar.

What about other income?

Yes, you do pay tax on other income you may have. So, for example, tax applies on:

- Income from business activities

- Income from directorships

- Income from trusts

- Investment income

- Rental income

- Royalties income

- Certain capital gains

- And when you are older on annuities & pensions

What must I do?

You can register through your employer via SARS eFiling or register for SARS eFiling and SARS will automatically register you and issue a tax reference number. Note that you must have a valid South African ID.

Follow these easy steps: 1. Go to www.sars.gov.za

2. Select ‘Register Now’

3. Follow the prompts

4. Request a Notice of Registration – it will reflect your income tax registration number

You can also register for SARS eFiling on the SARS MobiApp and follow the same steps.

To file a return you need an ITR12 which is tailored to your specific tax situation.

TOP TIP: The best is to do this is online and join 80% of all South Africans and become an eFiler. It’s so simple once you have a tax registration number. If you do your tax online your personal info is prepopulated by your employer. If it’s your first time filing online then why not try Help-You-eFile where our agent will help you through the process on line.

What does my employer do?

They withhold Employees tax from your salary and pay it to SARS monthly. Certain amounts can be deducted from your salary before Employees Tax is worked out such as money you might be saving towards a pension, medical aid and some insurance premiums. See our guide Income Tax and the individual.

So what happens?

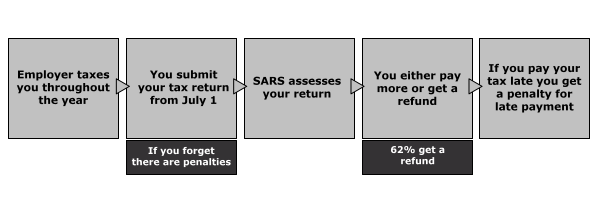

We’ve drawn a simple process chart to show you the stages.

And so after all that…

If you want to know the real details of what you’ll be paying then it’s all in the Minister’s Budget Speech. Remember as a South African taxpayer you’re responsible for everything good about our country. The Income Tax you pay enables the Government to meet the social and economic needs of our country and its people, ensuring a better life for everyone.

Related Documents

CRA01 – Confirmation of Residential or Business Address for Online Completion – External Form

IT180 – Declaration by Employer to Claim Deduction against Learnerships – External Form

LAPD-IT-G09 – Guide on the Tax Incentive for Learnership Agreements

RC01 – Application for Certificate of Residence for Individuals – External Form

RC02 – Application for Certificate of Residence for Persons other than Individuals – External Form

Frequently Asked Questions

FAQ: I will be starting to work overseas, but have never worked in South Africa nor registered for tax. Will I need to register and pay tax while working overseas?

South Africa has a residence-based tax system, which means residents...

Read MoreFAQ: I am currently employed by an overseas company who requires confirmation of my South African residency how do I obtain this?

The country where a SA resident rendered services or received...

Read MoreFAQ: How do I know that I fall within the definition of a resident?

a) The definition of resident refers to a natural person...

Read MoreFAQ: Do I have to be registered for Income tax to obtain a certificate of residence?

A person or partner in partnership (partner) must be registered...

Read MoreFAQ: How do I apply for a certificate of residence?

Where the South African resident rendered services or received income...

Read More