Below is a simple step by step guide to completing the DTR01.

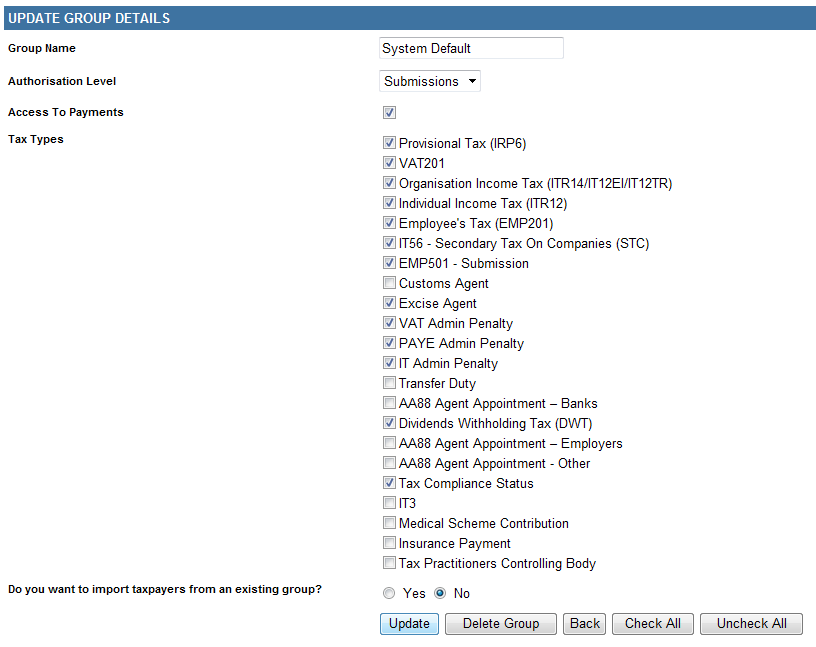

Once you have registered for Dividends Tax it also helps at this stage to update your user rights.

Simply click “update” to submit.

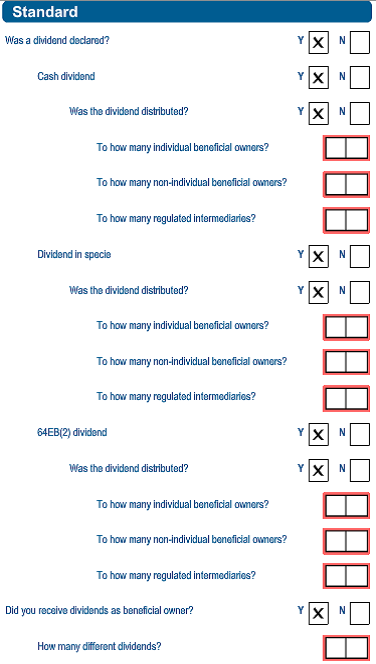

You must complete the DTR01 which is where you show all transactional data. Select ‘Submit New Data’ and click ‘Capture New Data’ and the “Data Submission Work Page” will be displayed. Below is an example of all the questions on the DTR01:

Just some pointers.

- Dividend in specie

A dividend in specie is a dividend other than in the form of cash, for example an asset. The market value of the dividend in specie is the amount deemed to be equal to the market value of the asset on the date that the dividend is deemed to be paid.

- Section 64EB(2) dividend

Where a person listed in section 64EB(2)(a) borrows a share in a listed company from another person after a dividend is announced or declared, any payment made by the borrower to the lender (i.e. the manufactured dividend) is subject to dividends tax.

-

Was the dividend distributed?

If ‘Yes’ is selected again, the wizard will ask if the dividend was distributed? Select ‘Yes’ of ‘No’. If ’Yes’, three separate questions will be displayed: -

To how many individual beneficial owners?

-

To how many non-individual owners?

-

To how many regulated intermediaries?

- Did you receive any exempt dividends as beneficial owner?

Answer ‘Yes’ or ‘No’.

If ‘Yes’ is selected, the wizard will prompt you to complete ‘How many separate dividends?

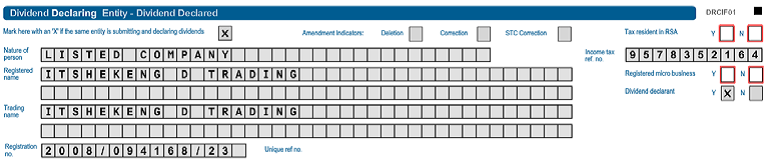

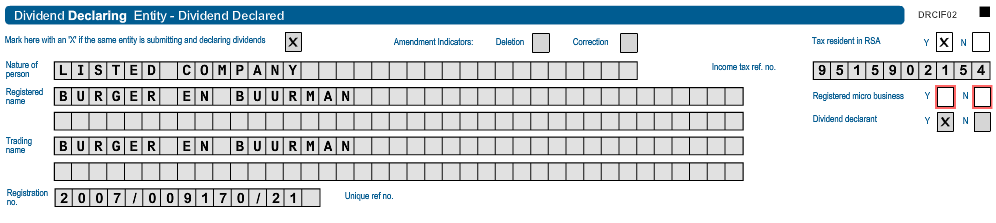

Mark here with an ‘X’ if the entity submitting this return also declared the dividend.

This field will be pre-populated from the wizard if you have selected ‘Yes’ from the question ‘Was a dividend declared?’

- Amendment Indications

This field will only be editable once a ‘Request for Correction’ is selected - Tax Resident in RSA

Select ‘Yes’ or ‘No’ if you are a tax resident in the country

-

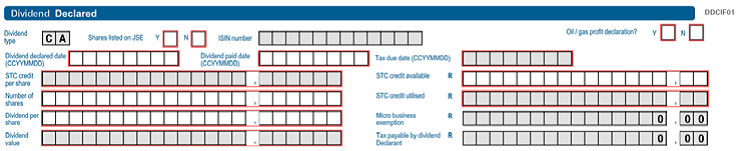

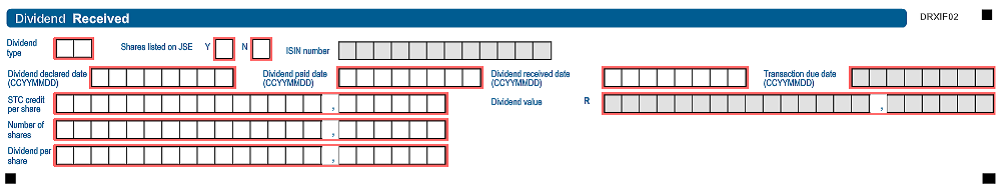

- Dividend Type

The dividend type will be pre-populated from the wizard, and will either be CA = Cash, IS = In Specie or EB - Shares listed on JSE

If the shares are listed on the JSE, select ‘Yes’ - ISIN number

If the shares are listed on the JSE, the ISIN number is compulsory and must be completed - Oil/gas profit declaration?

Answer ‘Yes’ or ‘No. If ‘Yes’ the allowable tax rate is 0.0%. - Dividend declared date (CCYYMMDD)

The date on which the dividend was declared/announced must be completed in the blocks provided - Dividend paid date (CCYYMMDD)

The date on which the dividend was paid out to the shareholders must be completed - Tax due date (CCYYMMDD)

This date will be populated when the ‘dividend paid date’ has been completed. The liability to pay the dividends tax is the end of the month following the month in which the dividend was paid - STC credit per share

This field will be calculated by the form. It is the STC Credit Utilised divided by the Dividend Value multiplied by the number of shares - STC credit available

The STC credit amount available from previous years must be completed in Rands and Cents - STC credit utilised

This field will be populated by the form - Micro business exemption

This field will be populated by the form if a micro business exemption is applicable - Tax payable for dividend in specie

The tax payable for dividend in specie must be completed in Rands and cents.

- Dividend Type

This section must be completed by a company/trust, etc. reporting on dividends received as beneficial owner.

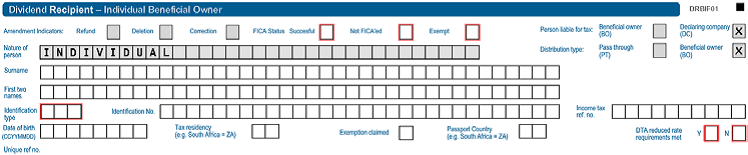

- FICA Status indicators

Select the appropriate status Successful, Not FICA’ed or Exempt Identification type

Select the applicable identification type from a pre-populated list - Identification number

Complete your ID number or passport number - Person liable for tax

Beneficial owner (BO) or the Declaring Company (DC). This field will be pre-populated - Distribution type

Pass through (PT) or beneficial owner (BO). This field will be pre-populated - Income tax ref no

Complete the income tax reference number of the beneficial owner - Tax residency (e.g. South Africa = ZAF)

Select the applicable tax residency from a pre-populated list - Exemption claimed

Select the exemption claimed under which paragraph from a pre-populated list - Passport country (e.g. South Africa = ZAF)

The correct passport country must be completed - DTA reduced rate requirements met

If there is a double taxation agreement between RSA and another country and a reduced rate is applicable, ‘Yes’ must be selected.

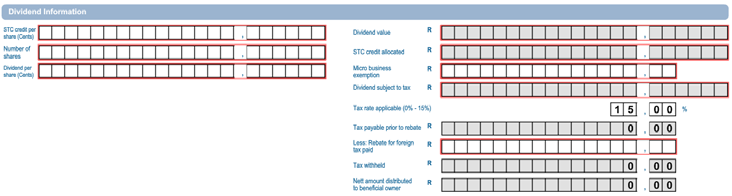

- STC credit per share (Cents)

It is the STC credit utilised divided by the Dividend value multiplied by the Number of shares. Complete the value in cents. - Dividend per share (Cents)

The dividend per share amount must be completed in Cents - STC credit allocated

The STC credit amount will be populated once the STC credit per share has been completed - Micro business exemption

If a micro business exemption is applicable, the exemption amount must be completed in this field - Dividend subject to tax

This field will be calculated and populated by the form - Tax rate applicable (0%-15%)

The correct tax rate must be completed (unless defaulted based on earlier selections) - Tax payable prior to rebate

This field will be calculated and populated by the form - Less: Rebate for foreign tax paid

Any rebate received for foreign tax paid must be completed in this field - Tax withheld

This field will be calculated and populated by the form - Net amount distributed to beneficial owner

This field will be calculated and populated by the form.

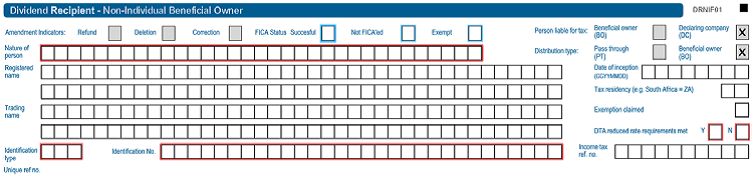

- Amendment indicators

This field will only be editable once a ‘Request for Correction’ is selectedFICA Status indicators

Select the appropriate status Successful, Not FICA’ed or Exempt. - Nature of person

This field must be completed from a pre-populated list - Identification type

Select the applicable identification type from a pre-populated list - Identification number

Complete your ID number or passport number - Person liable for tax

Beneficial owner (BO) or the Declaring Company (DC). This field will be pre-populated - Distribution type

Pass through (PT) or Beneficial owner (BO). This field will be pre-populated - Date of Inception (CCYYMMDD)

This is the date that the company/trust started - Tax residency (e.g. South Africa = ZAF)

Select the applicable passport country from a pre-populated list - Exemption claimed

Select the exemption claimed under which paragraph from a pre-populated list - DTA reduced rate requirements met

If there is a double taxation agreement between RSA and another country and a reduced rate is applicable, ‘Yes’ must be selected.

Top tip: The Dividend information will be exactly the same as for the Individual Beneficial owner.

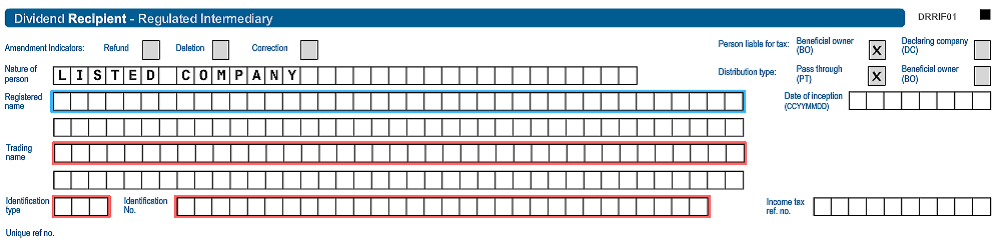

This section must be completed by the entity that received dividends as regulated intermediary for distribution.

This section must be completed by the entity reporting on cash dividends that they distributed.

- Mark here with an ‘X’ if the entity submitting this return also declared the dividend

This field will be pre-populated from the wizard if you selected ‘Yes’ from the question ‘Was a dividend declared?’ - Amendment Indications

This field will only be editable once a ‘Request for Correction’ is selected

You will then be asked to supply details of the entity who paid the dividend

Simply fill in this section with all the details of the dividend received

Companies with a small number of stakeholders can use eFiling to capture the relevant supporting data. The data will be consolidated into the Dividends Tax Return which will be sent to SARS.

After completing the DTR01, click ‘Save Return’ in the left hand corner of the return.

The message ‘Your return has been successfully saved on the eFiling system’ will be displayed.

If all the information has been completed correctly, the return can be submitted to SARS by clicking on ‘File Return’ on the left hand corner of the DTR01 return. The message ‘Your return has been successfully submitted’ will be displayed.

Top tip: If you have made a mistake follow our easy step by step guide as to how to amend the DTRO1