Follow the easy steps below to register for VAT on eFiling.

Steps:

1. Login to eFiling

2. Navigate to SARS Registered Details functionality:

- On the Individual portfolio, select Home to find the SARS Registered Details functionality

- On the Tax Practitioner and Organisations eFiling profiles, the SARS Registered Details functionality is under the Organisations menu tab

3. Select Maintain SARS Registered Details

4. The Maintain SARS Registered Details screen will display. Select I Agree to confirm that you are authorised to perform maintenance functions of the registered details of the company or individual.

5. Click VAT under My tax products > Revenue on the left menu

6. Select Add new product registration to register new or additional VAT branch registration:

![]()

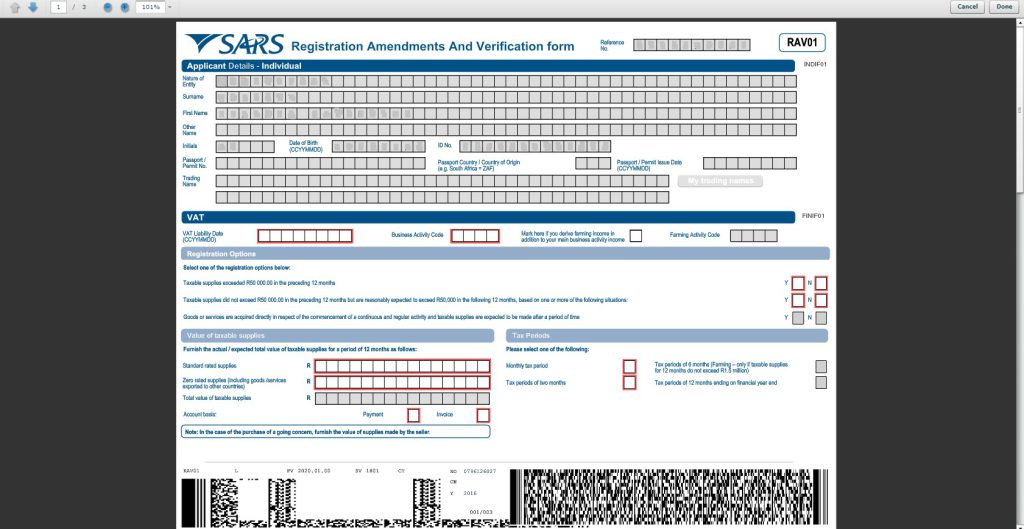

Please note: The VAT Liability Date must not be prior to 01 September 1991 and not more than 3 months in the

future:

- For new VAT registrations the VAT liability date must not be backdated for more than six months from today’s date. Should the liability date exceeds the six months, you will be required to visit the SARS branch with supporting documents such as financial statements, signed contracts or invoices issued (necessary supporting documents) to request a further back dating.

- For existing VAT registrations no back dating of the VAT liability date will be allowed via eFiling channel. You are required to visit the SARS branch with the necessary supporting documents to request an amendment to the VAT liability date.

- For voluntary new VAT registrations the back dating of the liability date will not be allowed and the system will set it to “today’s date”. In the event where you have charged VAT prior to registration, request the backdating by visiting a SARS branch with the necessary supporting documents to prove the back dating of the VAT liability date.

A warning message will appear if the liability date has not been entered correctly with an instruction to visit a branch with the necessary documentation.

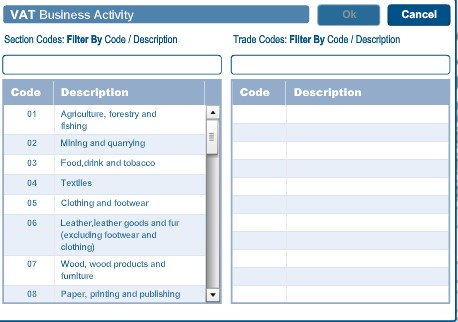

8. If you select the business activity code field, the VAT Business Activity box will display to select the section and trade codes applicable to your business. Select the “Ok” button to continue after selections have been made.If you select the business activity code field, the VAT Business Activity box will display to select the section and trade codes applicable to your business. Select the “Ok” button to continue after selections have been made.

Please note: As part of the new provisions based on legislative changes in respect of Voluntary Registrations, this selection now allows those applicants who do not yet exceed the R50 000 taxable supplies to continue with the registration if the applicable supporting documents based on the business activity selected, can be provided or submitted during the interview.

9. If your answer to the question ‘Taxable supply exceeded R50,000 in the preceding 12 months’, is ‘Y’ for yes, then the sum of standard rated supplies and zero rated supplies must be more than R50,000. If you have answered ‘N’ to the ‘Taxable Supplies exceeded in the preceding 12 months’ then the expected Taxable Supplies question must be answered Y and if you have answered Y to the fact that you have not yet exceeded this amount, you are required to indicate when and how you will expect to reach the R50 000 Taxable Turnover. These questions are mandatory and you will be unable to proceed if this is not completed.

Please note: If you select a different business activity code after you have received the containers for Diesel concession, you will receive the following error: ‘Mark here if you derive farming income in addition to your main business activity income: If you select this indicator, the “Farming Activity Code” field will be mandatory.

10. If you select the business activity code field, the Farming Activity codes will display to select the section codes and trade codes applicable to your business. Select the “Ok” button to continue after selections have been made. If you select the business activity code field, the Farming Activity codes will display to select the section codes and trade codes applicable to your business. Select the “Ok” button to continue after selections have been made.

VAT vendors can also request and obtain a VAT Notice of Registration on eFiling:

Follow these easy steps:

1. Login to SARS eFiling

3. Go to the Organizations main menu

4. Click SARS Registered details on the side menu

5. Select Notice of Registration

6. Select VAT.