To submit and pay WTI, follow these easy steps:

Make sure you have a valid Income Tax reference number. If you are not registered for Income Tax or you can’t remember your Income Tax reference number, please visit your nearest SARS branch or call the SARS Contact Centre on 0800 00 7277 for assistance.

- Log on to the eFiling website with your eFiling Login Name and Password.

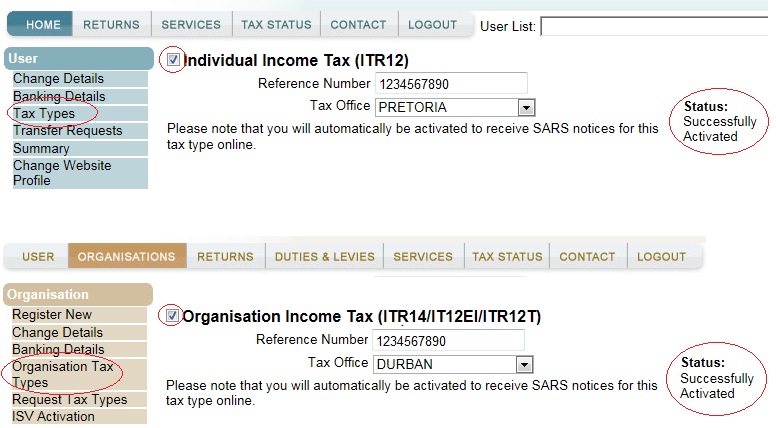

- Check if the ‘Income Tax’ under ‘Tax Types’ has been activated for eFiling. If not, please activate the Income Tax reference number.

- If you register as a ‘Company representative’, it must be your individual income tax reference number completed in the representative screen and not the company tax reference number.

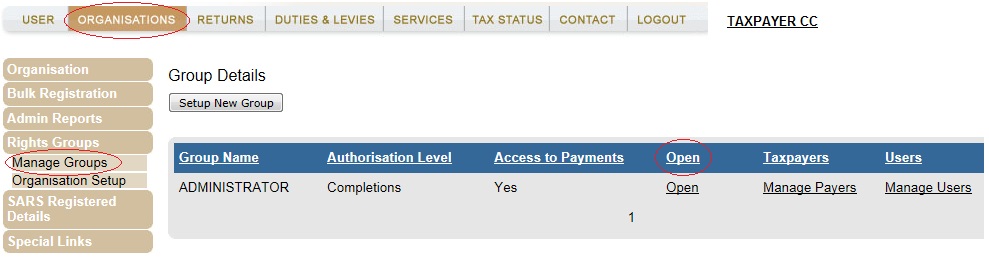

- Before you proceed with registering, please make sure that your ‘rights’ have been activated. If you are a tax representative or a tax practitioner, add the ‘Withholding Tax on Interest (WTI)’ tax type to the group details:

- Select ‘Organisations’

- Click on ‘Rights Groups’

- Select ‘Manage Groups’

- Click on ‘Open’

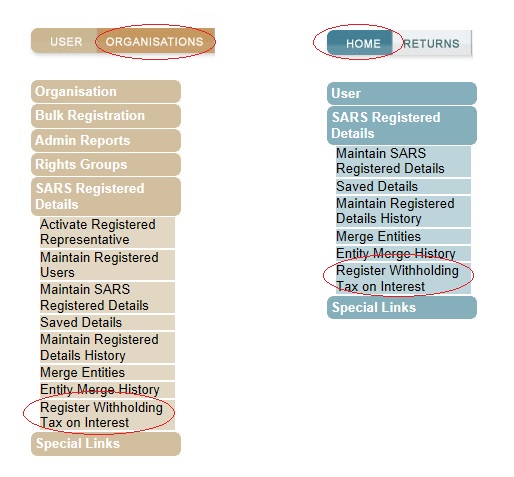

- Select the ‘Authorisation Level’

- Mark the check box for ‘Withholding Tax on Interest (WTI)’:

- To register for the WTI on eFiling:

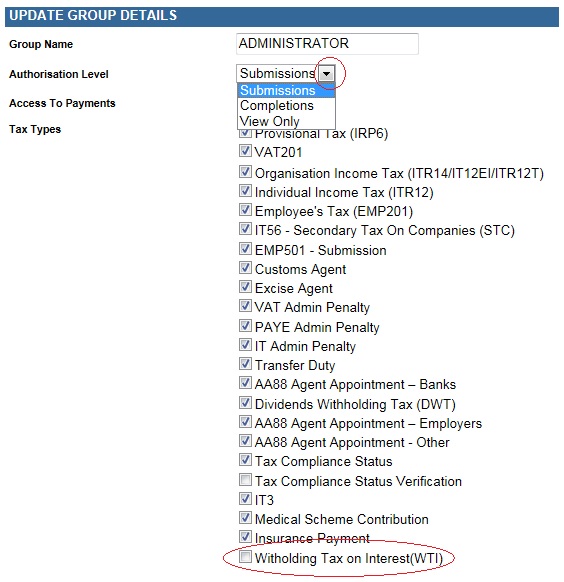

- If you are a Tax Practitioner or Tax Representative, select a taxpayer from the drop down list and then click on:

- ‘Organisations’

- ‘SARS Registered Details’

- ‘Register Withholding Tax on Interest’

- If you are an Individual click on:

- ‘Home’

- ‘SARS Registered Details’

- ‘Register Withholding Tax on Interest’

- If you are a Tax Practitioner or Tax Representative, select a taxpayer from the drop down list and then click on:

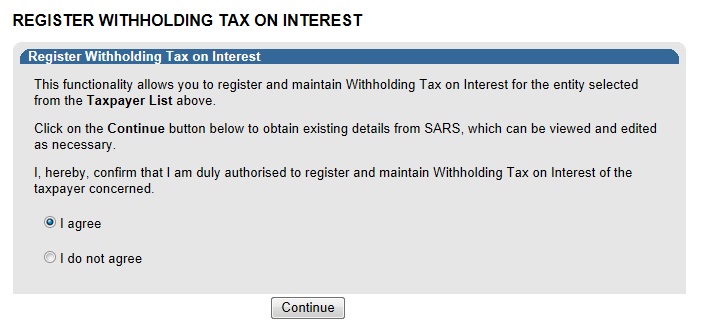

- Read the disclaimer on the screen below:

- Select ‘I Agree’

- Click on ‘Continue’

- When the ‘Continue’ button is clicked the system will validate if the taxpayer is activated for Income Tax on eFiling.

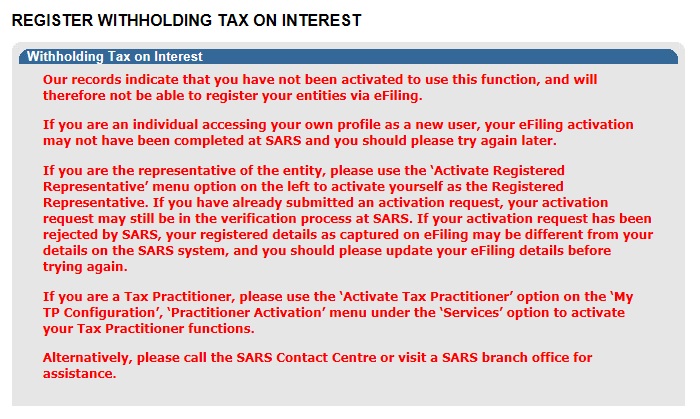

- If not activated for Income Tax on eFiling an error message will display:

- If you do not have an Income Tax number, please contact the SARS Contact Centre for assistance or visit your nearest SARS Branch to register for Income Tax.

- If you do have a valid Income Tax number, please use the Tax Types option to activate for Income Tax on eFiling.

- If you are not an Active Registered Representative or an Active Tax Practitioner, an error message will display:

- To activate as a representative, please select the following options:

- ‘Organisations’

- ‘SARS Registered Details’

- ‘Activate Registered Representative’

- To activate as a tax practitioner, please select the following options to activate:

- ‘Services’

- ‘My TP Configuration’

- ‘Practitioner Activation’

- To activate as a representative, please select the following options:

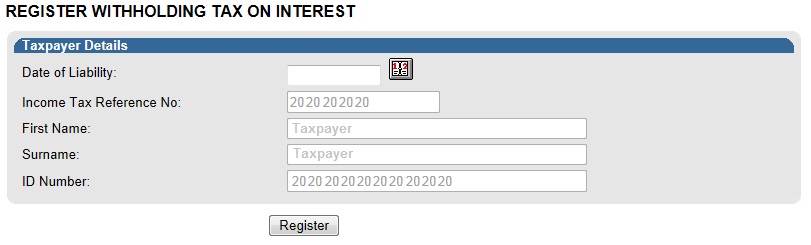

- If the tax number is successfully activated for Income Tax on eFiling, the following screen will display:

- The ‘Taxpayer Details’ will be pre-populated as per the taxpayer’s eFiling profile.

- Click on the calendar icon and select the date from which you are liable for WTI. This date cannot be before 1 March 2015.

-

Click on ‘Register’.

-

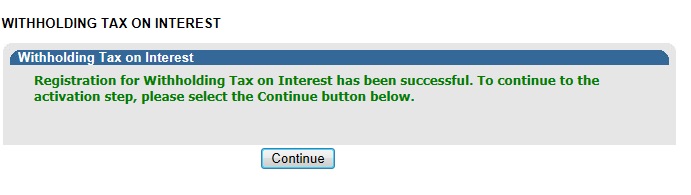

A pop up screen will display to confirm that the WTI registration was successful. Click on ‘Continue’. The ‘Activation for Withholding Tax on Interest’ screen will display next.

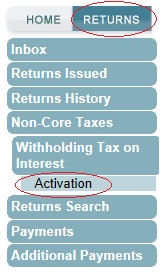

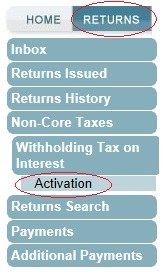

- Click on ‘Returns’

- Then on ‘Activation’:

- Select ‘Returns’ and then click the following:

- ‘Non-Core Taxes’

- ‘Withholding Tax on Interest’

- ‘Activation’

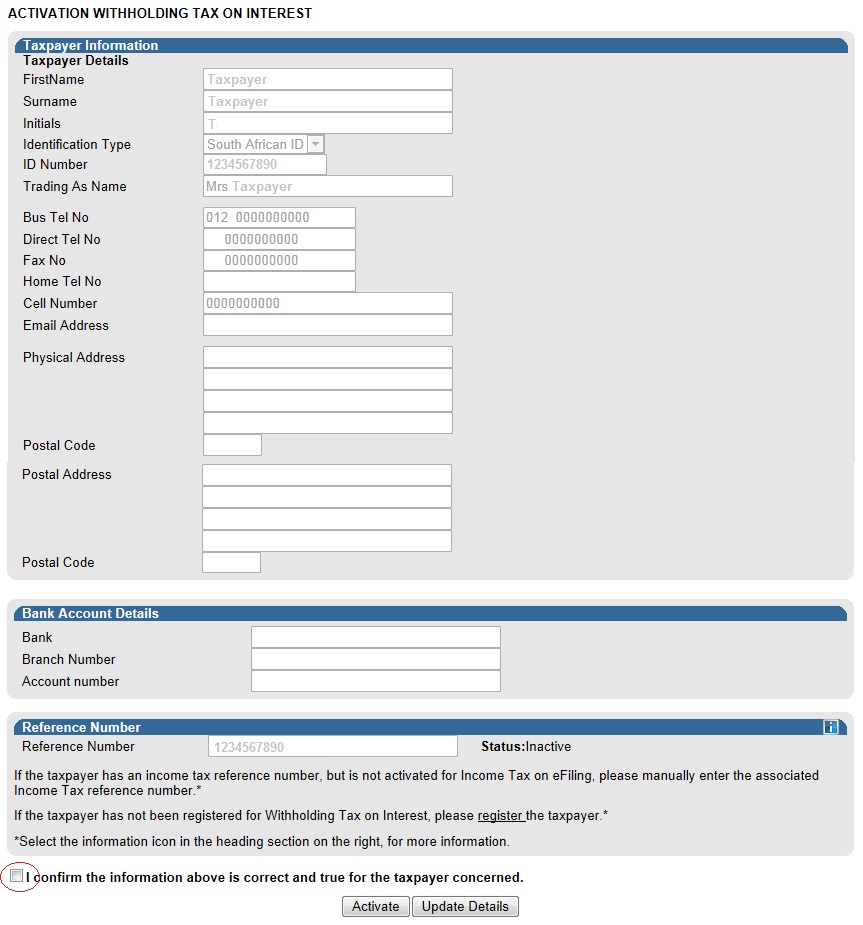

- The activation screen will display:

- The ‘Taxpayer Information’ will be prepopulated with the data available.

- If the prepopulated information is incorrect, click on ‘Update Details’ to make the relevant changes.

- If the prepopulated information is correct, select the checkbox for the disclaimer “I confirm the information above is correct and true for the taxpayer concerned”

- Click on ‘Activate’.

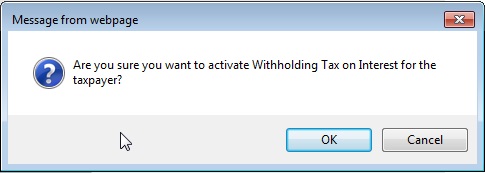

- Click on ‘OK’ on the pop-up message to confirm you want to activate the tax number for Withholding Tax on Interest:

- The activation request will be validated by the system:

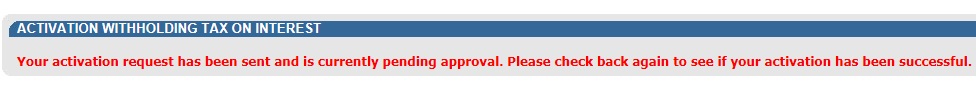

- If the WTI activation is pending approval the following message will display:

“Your activation request has been sent and is currently pending approval. Please check back again to see if your activation has been successful.”

- If the WTI activation is pending approval the following message will display:

- If your information does not match the SARS records the following message will display:

“Unfortunately, we could not match the details supplied. Please check that all details are correct and try again or contact us if the problem persists”. - Please contact the SARS contact centre on 0800 00 7277 for assistance.

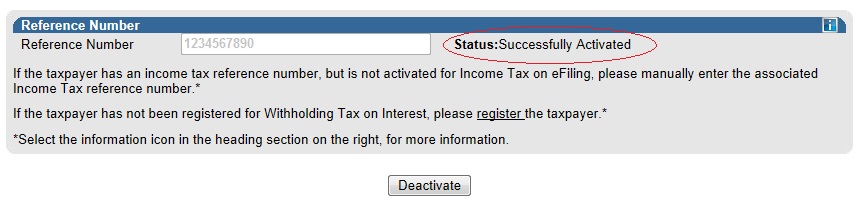

- If the reference number is activated for Withholding Tax on Interest, the status will indicate ‘Successfully Activated’

- Select ‘Returns’ and then click the following:

- ‘Non-Core Taxes’

- ‘Withholding Tax on Interest’

- ‘Activation’

- The activation screen will display:

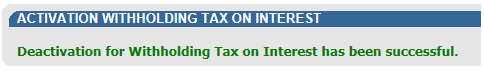

- Click on ‘Deactivate’

- Click on ‘OK’ on the pop-up message to confirm deactivation.

- The deactivation will be confirmed.

- To open the Withholding Tax on Interest return page click on ‘Issued/Saved Declaration’ from the menu on the left:

- If there are no previous requests for a return, there will be no records to display in the return grid

- Click on the dropdown menu and select the relevant period

- Click on ‘Request Return’

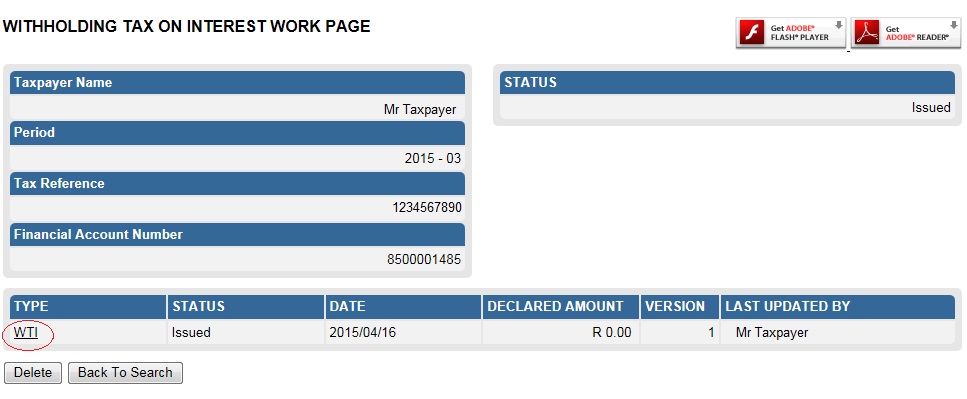

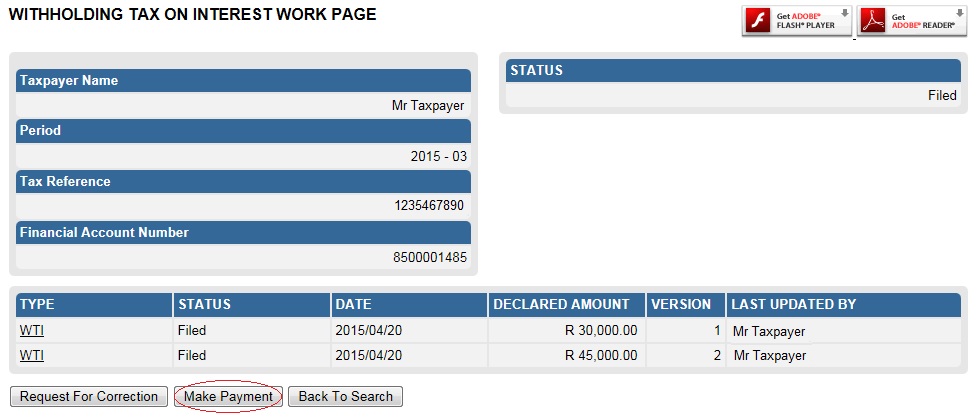

- The Withholding Tax on Interest Work Page will display:

- The status of the return period requested will be ‘Issued’

- Click on the ‘WTI’ link to open the return.

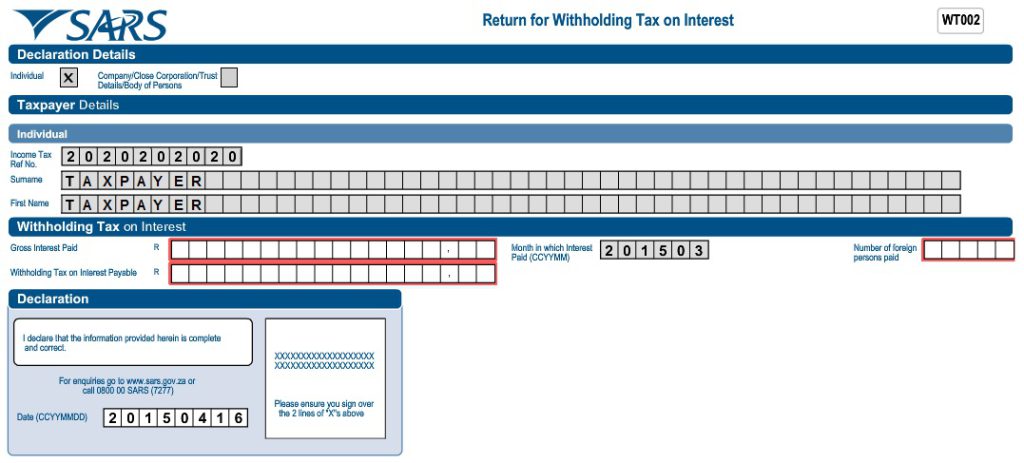

- The Return for Withholding Tax on Interest – WT002 will display on your screen.

- The following fields will be auto-completed on the return:

- The taxpayer’s capacity, i.e.:

- Individual or

- Company/Close Corporation/Trust Details/ Body of Persons

- Income Tax Ref No

- If the taxpayer is an ‘Individual’:

- Surname

- First Name

- If the taxpayer is a ‘Company/Close Corporation/Trust Details/ Body of Persons’:

- Registered Name

- Trading or Other Name

- The taxpayer’s capacity, i.e.:

- Complete the Withholding Tax on Interest section of the return:

- Gross Interest Paid

- Withholding Tax on Interest Payable – this amount must be 15% of the gross interest paid to the foreign person

- Number of foreign persons paid

- Month in which interest paid – the return period selected will be prepopulated in this field.

- Click on ‘File’ to submit the return to SARS. Should you wish to save return and file it at a later stage click on ‘Save Online’:

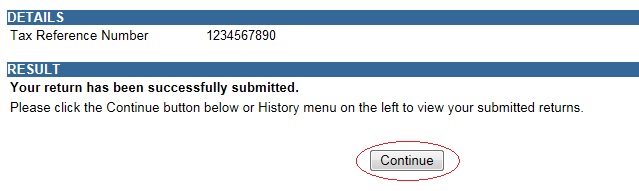

- A message will display to confirm the successful submission of your return:

- Click on ‘Continue’.

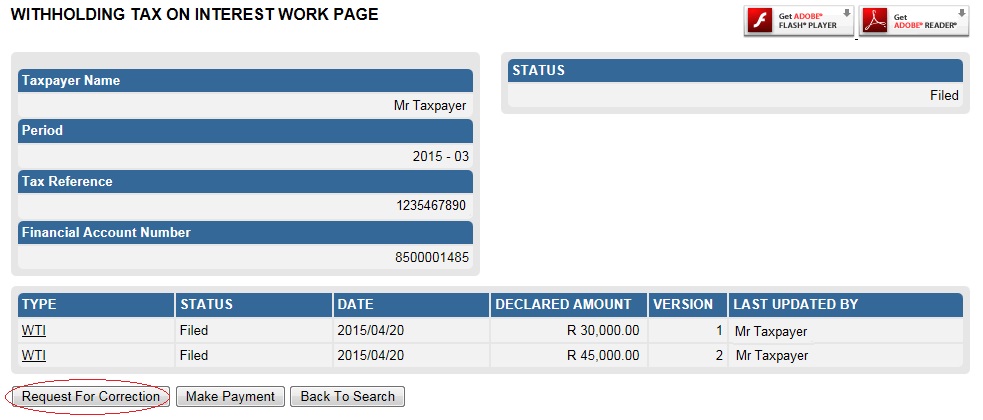

- You will be redirected to the Withholding Tax on Interest Work Page:

- Select ‘Request for Correction’ if you wish to amend the return

- Select ‘Make Payment’ to pay the return amount.

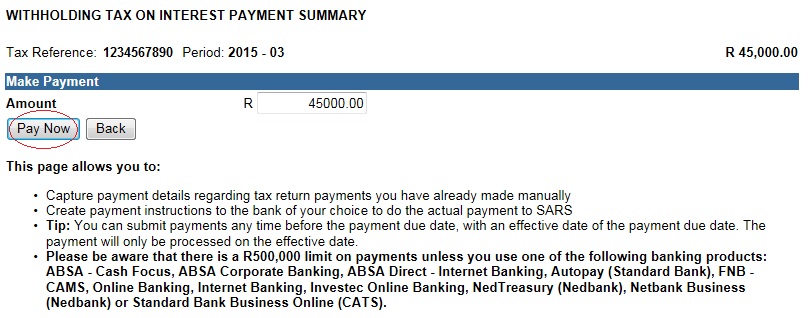

- Payments for WTI can only be made via eFiling. Payments can’t be made at a SARS Branch or at a Bank.

- Please ensure that your banking details are set up correctly on eFiling before you make a payment.

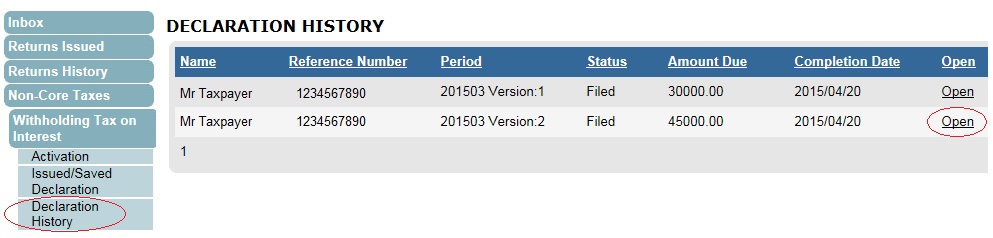

- To access unpaid WTI payments select the following from the menu on the left:

- ‘Non-Core Taxes’

- ‘Withholding Tax on Interest’

- ‘Declaration History’

- Identify the required return and click on ‘Open’. The ‘Withholding Tax on Interest Work Page’ will display.

- On the Withholding Tax on Interest Work Page:

- Click on ‘Make Payment’

- A pop up screen will display with the message: ‘Are you sure you wish to continue?’

- Click on ‘OK’ (The ‘Payment Summary’ screen will display).

- On the Payment Summary screen:

- The ‘Amount’ field will be prepopulated with the outstanding amount due for the period. This amount can be edited.

- Click on ‘Pay Now’.

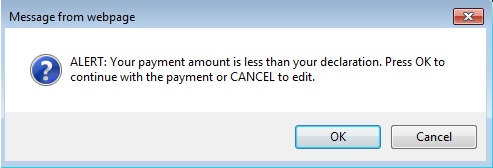

- If the payment amount is less than the amount declared on the return, a warning message will display. Click on ‘OK’ if you wish to continue.

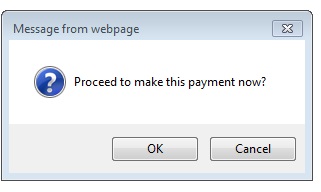

- Click ‘OK’ on the pop up screen to proceed with the payment. (The ‘Payment Details’ screen will display).

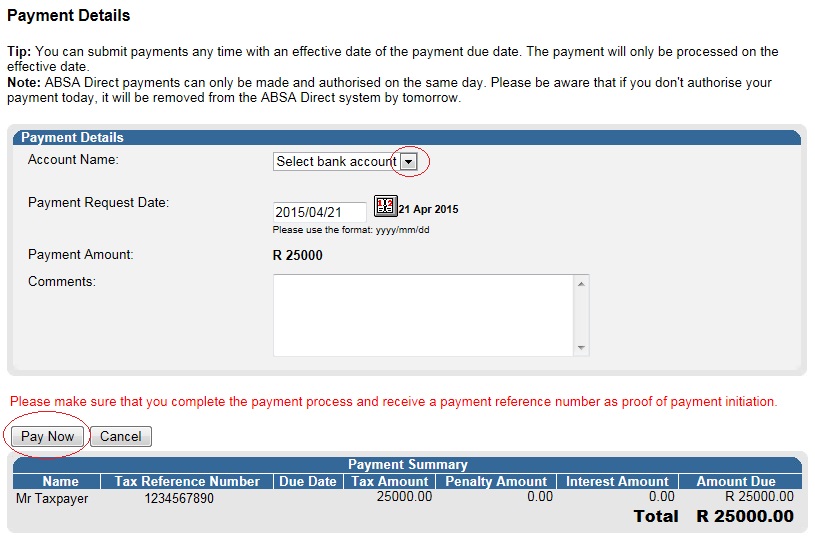

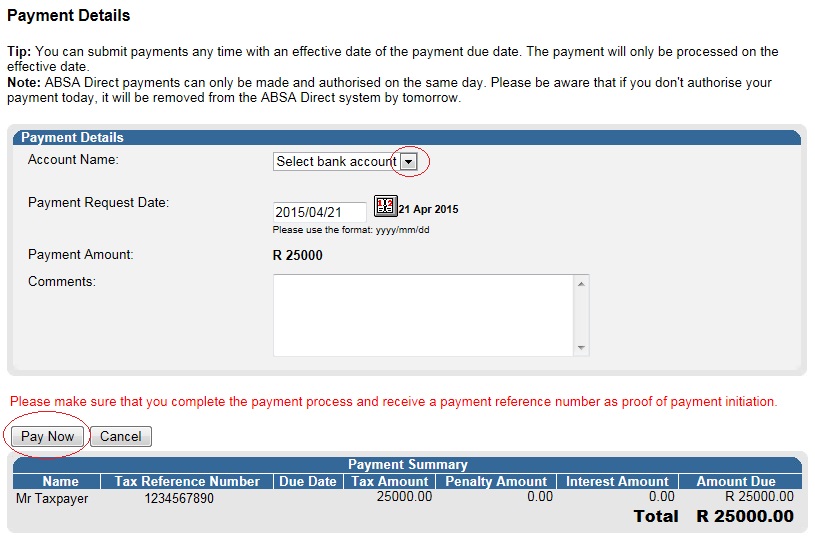

- On the Payment Details screen:

- Select the bank account from the drop down list.

- Ensure that the payment request date is correct.

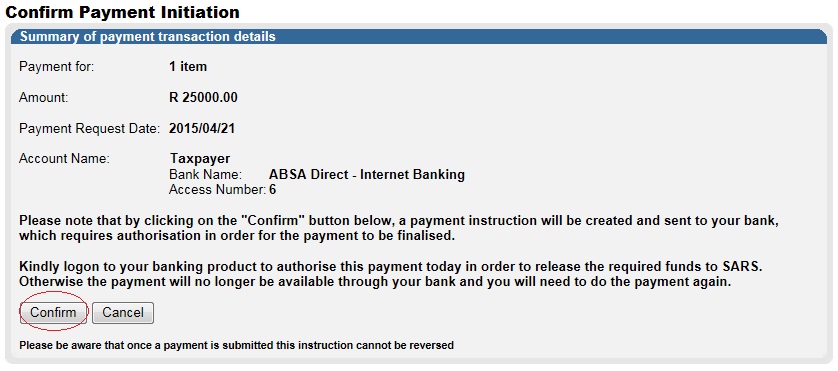

- Click on ‘Pay Now’ (The ‘Confirm Payment Initiation’ screen will display).

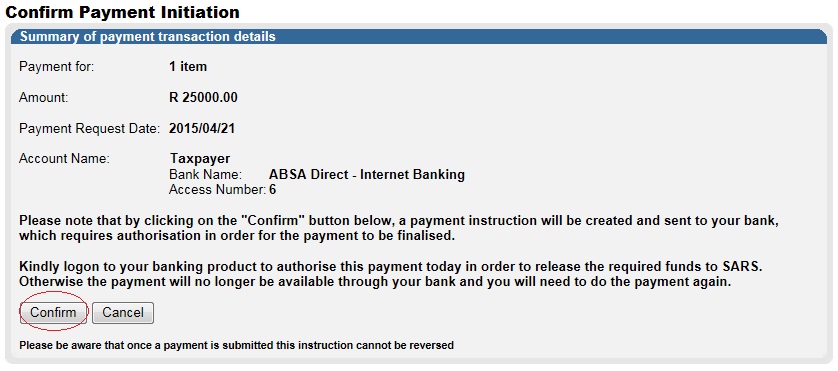

- On the Confirm Payment Initiation screen click on ‘Confirm’:

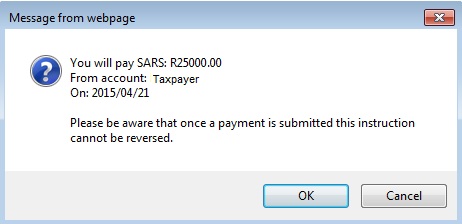

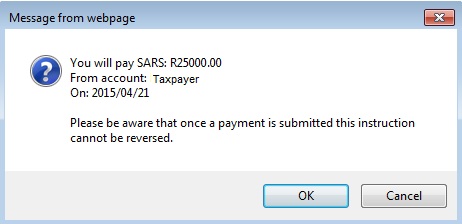

- A pop up message will display for you to confirm the payment amount, account and date of payment. Click on ‘OK’ to proceed.

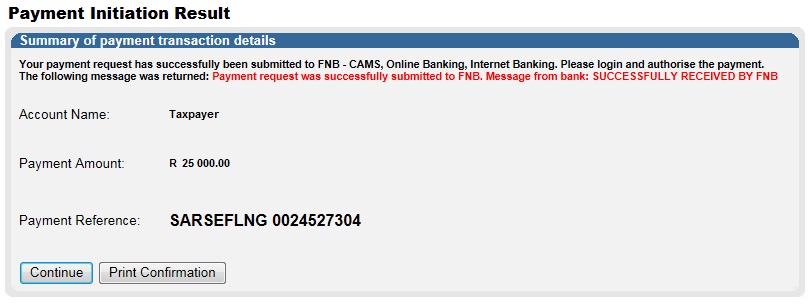

- The payment initiation result will display:

- On the Confirm Payment Initiation screen click on ‘Confirm’:

- A pop up message will display for you to confirm the payment amount, account and date of payment. Click on ‘OK’ to proceed.

- The payment initiation result will display:

- Please log on to your bank account to authorize the payment.

- After the payment is authorized the payment status will change to ‘Payment Successful’:

Need help?

Call the SARS Contact Centre on 0800 00 SARS (7277).