Pretoria, Thursday 01 April 2021 – The South African Revenue Service (SARS) announces its preliminary revenue results outcome after a year of National COVID-19 lockdown regulations. The extra out-of-ordinary pandemic circumstances changed the economic landscape and the way SARS operates to collect the tax revenue due. The main drivers of the reported revenue are the impact of renewed tax administrative efforts to improve taxpayer compliance, domestic and global constraints on economic activities and the related tax relief measures implemented in lieu of the COVID-19 pandemic restrictions.

As part of SARS Vision 2024, the newly instituted organisational and operational rearrangements enabled the cascading of the management of taxpayers’ accounts to nine regions and three segments while the re-establishment of the large and international business unit was further entrenched and made operational, in both instances leading to improved focus on revenue and taxpayer service. Details relating to the SARS strategic journey towards rebuilding a Smart and Modern SARS with Unquestionable Integrity, Trusted and Admired are provided on our website, accordingly this aspect and compliance related activities are not addressed in this release. We now turn to the revenue performance for the financial year 2020/21.

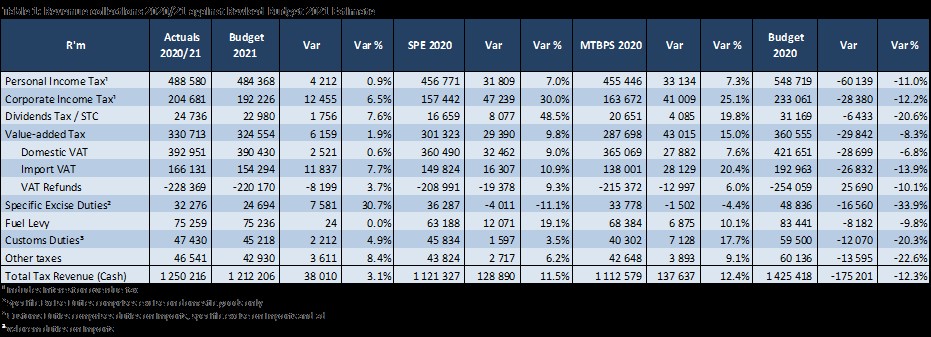

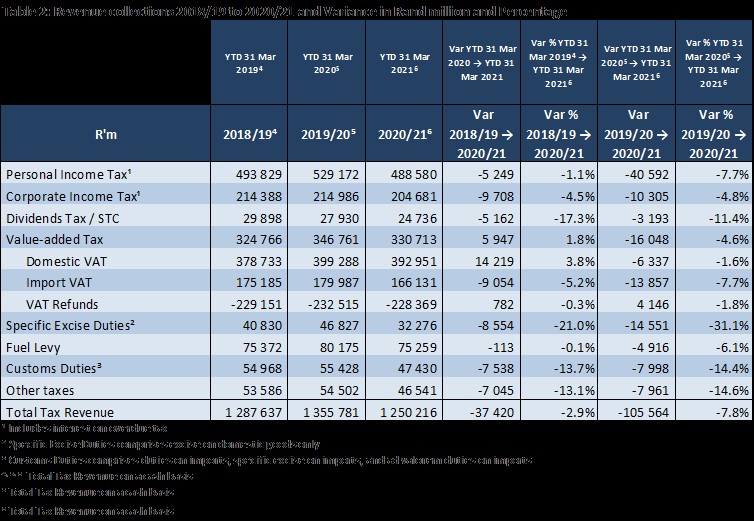

For the period ending 31 March 2021, SARS collected a gross amount of R1 541.1 billion which was offset by refunds of R290.9 billion, resulting in net collections of R 1 250.2 billion, versus Budget 2021 Revised Estimate of R1 212.2 billion, and which represented a contraction of –R105.6 billion ( -7.8%) against the 2019/20 financial year.

The 2021 Budget Printed Estimate for 20201/22 is set at R1 365.1 billion representing a growth of 12.6% against the 2021 Budget Revised Estimate (RE) for 2020/21 of R1 212.2 billion. The main assumptions underpinning this estimate is nominal growth in GDP of 8.8% with a tax-to-GDP extraction ratio of 25.5%. Against the preliminary 2020/21 collections of R1 250.2 billion, the 2021/22 estimate of R1 365.1 billion represents a growth of R114.9 billion (9.2%).

It should be noted that these are preliminary results, which will be subject to detailed financial reconciliation and a final audit.

It is understood that revenue outcomes are in the main underpinned by the state of the economy, fiscal policy measures, public confidence in the tax administration and the overall government, as well as improved administrative efficiencies by SARS. The nominal value of economic activities consists of two components, namely a real growth rate and an inflation rate. Over the past years, tax revenue collections have continued to perform below expectations driven by below potential real economic growth within a lower inflation environment, which has led to a moderation in the collection of some major tax categories.

The second component on revenue collected is driven by tax administrative actions that resulted in additional cash collections and non-cash revenue that secures the tax base. For the period under review, R158.5 billion represented revenue collected by SARS with close to R94.1 billion in additional cash collections and the remaining R64.3 billion non-cash collections. The latter represents compliance activities that led to revenue leakage protection.

Revenue collections were secured by the revenue plan executed throughout the financial year, which was closely managed in collaboration with regional and national revenue recovery anchors to ensure successful delivery on the desired collection outcomes. The collapse in global economic activity in 2020 is estimated to have been slightly less severe than previously projected, mainly due to shallower contractions in advanced economies and a more robust recovery in China.

A higher-than-expected rebound in economic activities after the easing of economic lockdown measures resulted in better-than-expected tax revenue collections. Corporate income tax collections recovered in the last quarter of 2020, driven mainly by higher international commodity prices. Pay-As-You-Earn (PAYE) collections continue to be challenged by sluggish employment and wage growth, as well as lower bonus payments. Despite seeing a contraction in Domestic VAT liabilities during the first fiscal quarter, early signs of recovery were noted from July onwards. Although the announcement of an adjusted lockdown level 3 during December 2020 caused a contraction in Domestic VAT liabilities for February, this was short-lived as Domestic VAT collections in March bounced back with month-on-month growth of 8.5%. The full reporting period saw a contraction in both the volume and value of Domestic VAT liabilities of 7.1% and 2.3% respectively.

The South African economy is in a deep contraction phase. The annual contraction for 2020/21 in the value of real gross domestic product (GDP) is estimated at -8.3%. Quarterly annualised growth rates tend to be more volatile, especially for 2020 when the second quarter recorded a contraction of -51.7% followed with a rebound in the third quarter, after the easing of the lockdown measures, to post an increase of 67.3%. All industries recorded positive growth between the second and third quarters of 2020.

The largest positive contributors to growth in GDP in the third quarter were the manufacturing, mining and trade industries. The manufacturing industry increased at a rate of 212.9% and contributed 16.4 percentage points to GDP growth. The mining and quarrying industry increased at a rate of 271.2% and contributed 11.4 percentage points. The trade, catering and accommodation industry increased at a rate of 137.0% and contributed 14.7 percentage points.

The main sources of revenue that contributed to the R1 250.2 billion collected were Net personal income tax (PIT), which contributed R488.6 billion (39.1%), Net value-added tax (VAT) contributing R330.7 billion ( 26.5%), Net company income tax (CIT), which contributed R204.7 billion (16.4%) and Customs duties which contributed R47.4 billion (3.8%). The relative contribution of the main taxes to total tax revenue has shifted with an ever-increasing dependence on PIT revenue mainly due to tax policy changes. The contribution of Domestic VAT collections continue to decrease mainly due to a weak economic growth environment with lower consumer and investment spending in the economy. CIT’s contribution to total tax has been declining over the past years, decreasing to a low of 15.9% in 2019/20, with a slight improvement in 2020/21 to 16.4% due to demand constraints on sales and business profits.

The major contributors to the surplus against the 2021 Budget revised estimate (RE) are given below:

• Net PIT collections (including Interest on overdue taxes) were R4.2 billion (0.9%) higher than the RE, mainly due to higher PAYE and PIT provisional payments offset by higher refunds. PIT provisional payments were R1.7 billion (6.8%) higher than the RE. PAYE were higher than the RE by R6.5 billion (1.3%) offset by higher-than-expected PIT refunds of R2.7 billion (8.3%).• Net CIT collections (including Interest on overdue taxes) amounted to R204.7 billion, yielding a positive performance of R12.5 billion (6.5%) against the RE. This was as CIT provisional tax payments during the high collection month of February 2021 recorded a positive variance of R6.9 billion (27.0%), following the exceptional performance of SMME’s. The month of March 2021 also saw positive gains of R6.8 billion (38.2%) on the back of significant Paragraph 19(3) collections.• CIT refunds were also lower-than-expected by R0.9 billion (4.0%) against the RE as a result of lower CIT refunds paid out to the large business segment, particularly to the Mining sector.• Domestic VAT was R2.5 billion (0.6%) above the RE. Collections were boosted by the rebound in households’ real final consumption expenditure (FCE) in Q3-2020 as the lockdown restrictions were eased and the economy began a recovery path. FCE by households grew by a revised 75.3% q/q in Q3-2020 following the sharp contraction of 52.0% q/q in Q2-2020 from no growth in Q1-2020. FCE grew by 7.5% q/q in Q4-2020.• DT/STC collections amounted to R24.7 billion, yielding a slight increase of 7.6% against the RE. The heightened uncertainty in the economy has drastically affected the dividend distributions by companies. Companies maintained reserves and opted to suspend, defer or cancel dividend payments to their shareholders following the COVID-19 pandemic. Furthermore, the SA Reserve Bank urged commercial banks to freeze the payment of ordinary dividends or bonuses to executives this year. The COVID-19 pandemic forced companies to reassess their financial projections amidst the rapidly shifting landscape of the global economy.• Import VAT exceeded the RE by R11.8 billion (7.7%). However, collections were R13.9 billion (7.7%) less than prior year mainly due to declining growth rates from the largest commodity drivers of the tax; underpinned by the overall annual value of merchandise imports contracting by 12.6% for the period April 2020 to February 2021.• Customs Duties exceeded the RE by R2.2 billion (4.9%). However, collections were R8.0 billion (14.4%) less than prior year mainly due to declining growth rates from the largest commodity drivers of the tax; underpinned by the overall annual value of merchandise imports contracting by 12.6% for the period April 2020 to February 2021.• Specific Excise duty collections were R7.6 billion (30.7%) higher than the RE mainly due to higher cigarettes and wine sales; and R14.6 billion (-31.1%) less than prior year.• Fuel levies were slightly (0.03%) higher than the RE; and R4.9 billion (-6.1%) less than prior year mainly due to less fuel sales by local manufacturers.

We now turn to the contribution of the Large and International Businesses (LB&I) segment. The LB&I segment contributed R378.4 billion (30.3%) to SARS collections, which reflects a contraction of R23.0 billion (5.7%) compared to prior year. A significant narrowing of the contraction has taken place compared to earlier parts of the year as COVID-19 lockdown restrictions eased allowing for improved business activity in the latter part of the year.

• In the main contractions have been observed across all taxes, of which domestic VAT showed resilience reflecting a marginal contraction of 0.5% compared to prior year, mainly driven by significant improved collections from the mining and quarrying sector reflecting a growth of R3.5 billion (34.0%) and the wholesale and retail sector increasing by R1.2 billion (5.7%). Worth noting is that Domestic VAT payments has shown volatility throughout the year, with the March 2021 collections showing the first growth of 7.9%, since November 2020 (12.8%), which is aligned with manufacturing sector showing a marked increase in performance of R0.9 billion (35.6%), similarly improvements were noted for key sectors such as wholesaled and retail trade R0.2 billion (13.7%), electricity gas and water supply R0.1 billion (18.4%).• Despite the contraction observed for CIT provisional tax of R6.5 billion (4.6%), the overall contributions from the mining and quarrying sector across the respective taxes buffered the drag on collections totalling R41.6 billion, which represented an increase of R16.3 billion (64.3%) compared to prior year, supported by improved commodity prices, specifically in the platinum group metals (PGMs), gold and iron ore sub-sectors. In addition, Paragraph 19(3) collections totalled R14.6 billion reflecting a growth of R5.6 billion, (62.4%) against PY, which buffered CIT collections. Whilst on the other hand there were 641 companies that made a total payment of R7.6bn last year which have not repeated in the current year. The majority of these companies were from Finance (259) and Manufacturing (106) sectors, which contained the performance of this tax type.• PAYE performance for LB&I segment remains a significant concern with a recorded contraction of R12.9 billion (6.3%), largely underpinned by the weakened performance by the finance sector (-6.0%), amidst the persistent increase in job losses, liquidations, the reduction in earnings and subdued bonus pay-outs due to strained profitability under tough economic conditions. Just over 40% of PAYE revenue is generated from the Finance sector and given digital transformation, the sector is still expected to shed more jobs in the short to medium term.

There were two key pillars that assisted the performance of the LB&I’s revenue collections which has been a) the focused efforts around improving compliance, with a rapid response to non-compliance; and b) The ongoing or regular discussion with key taxpayers (the build-up to the collaborative compliance framework) on direction of their businesses.

SARS wishes to thank taxpayers for honouring their tax matters in the period under review and beyond.

REVENUE TABLES:

To access this page in different languages click on the links below: