Menu

What’s New?

- 12 March 2021 – Enhancements to the Tax Type Transfer process

As part of ongoing enhancements to eFiling, during 2020 the eFiling Tax Type Transfer process was updated for Personal Income Tax products. These changes provided the taxpayer with full control of their eFiling profiles. Furthermore, any transfer requests to access taxpayer profiles, now require the taxpayer or their appointed Registered Representative to approve or reject such requests.

How will the enhanced process work?

In the coming months, SARS will extend the above process to the remaining tax products and for all entities transacting on eFiling. Towards the end of April 2021, SARS will introduce the following key changes on eFiling:

- Adding taxpayers to a profile (Organisations & Practitioners)

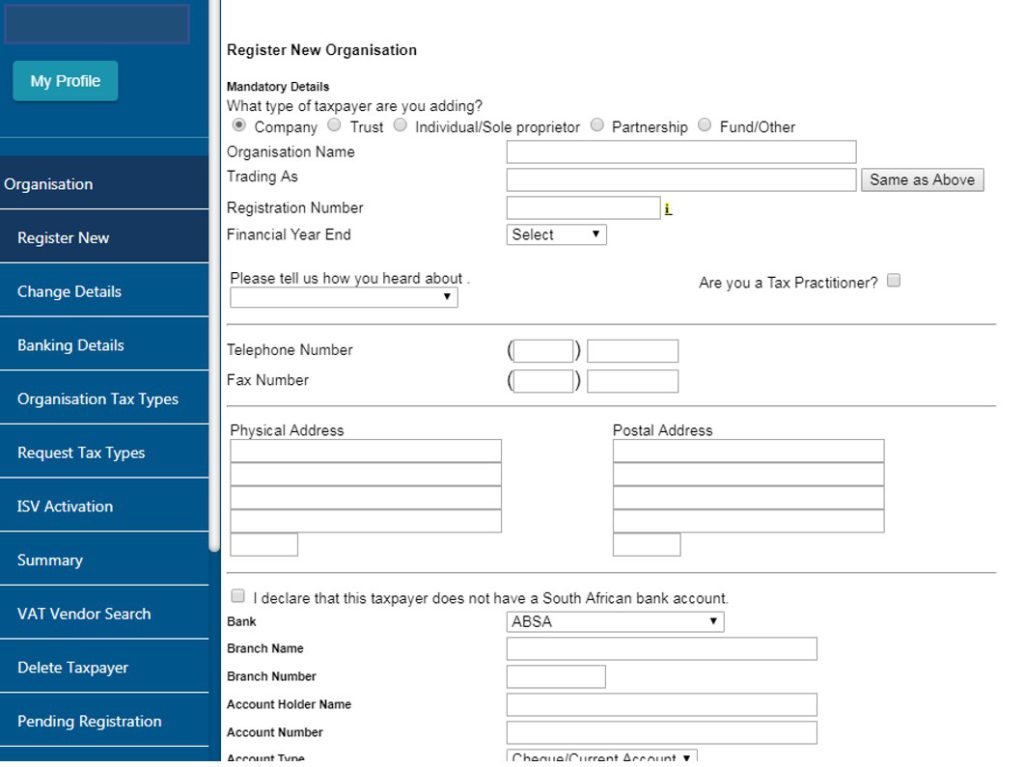

- Removing multiple capture fields to simplify process

- Validate captured information to ensure alignment to SARS records

- Activating and Requesting Tax Types (All products and return types)

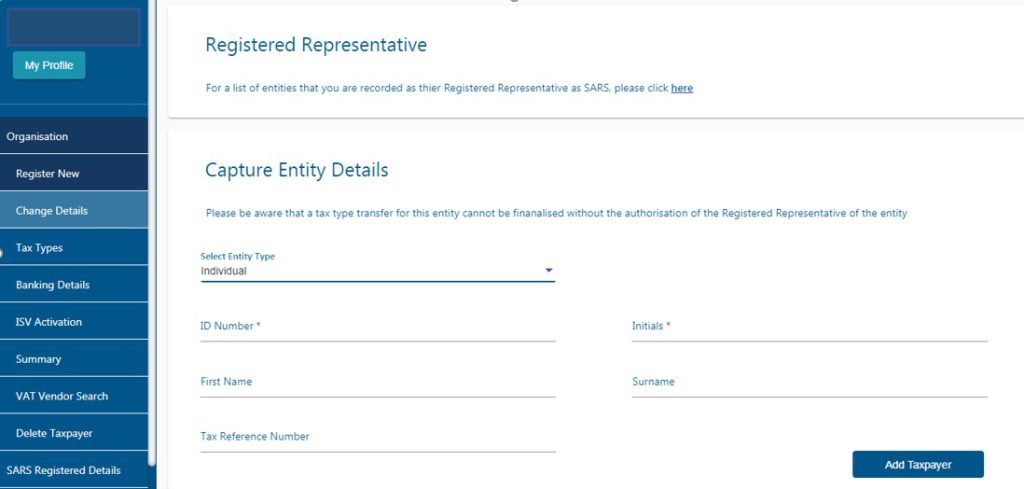

- Registered Representatives will have access to their clients

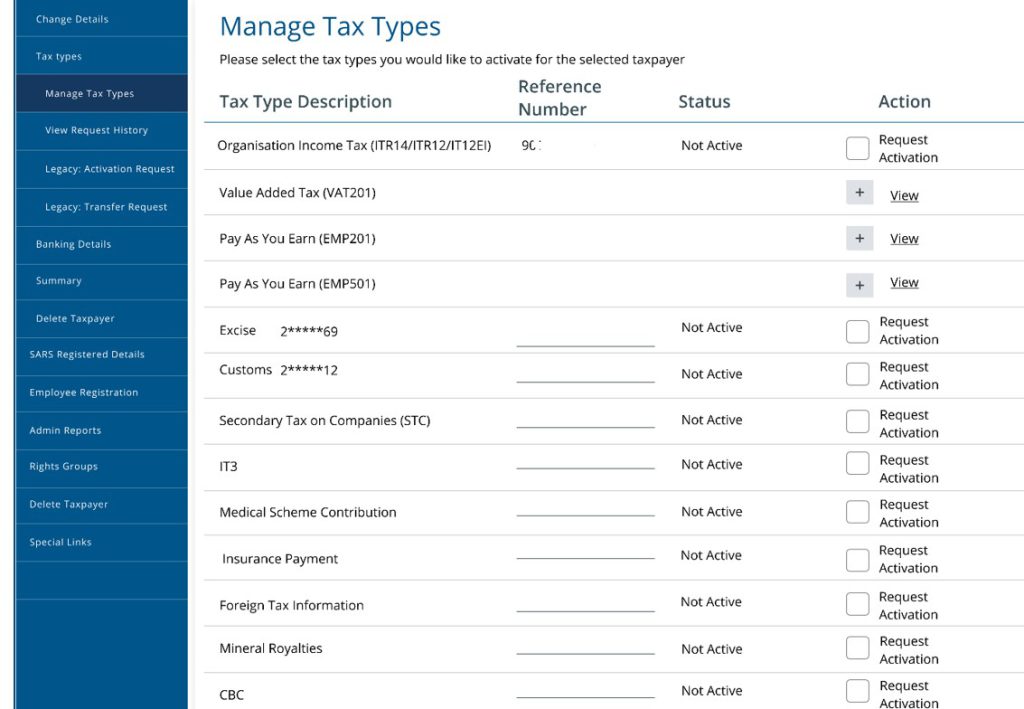

- SARS will provide products on register (masked) – user activates selected products

- Tax Type Requests to be reviewed by the taxpayer or their appointed Registered Representative

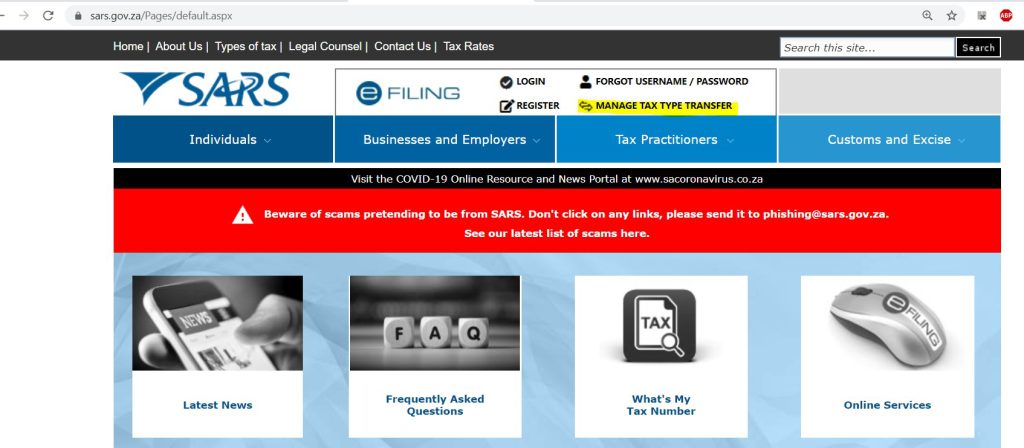

- Manage Tax Types on www.sars.gov.za

- Authentication layer with One-Time-Pin (cell and email)

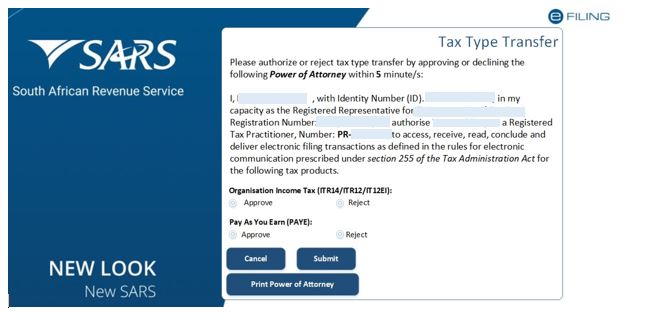

- Online Power of Attorney (POA) for Tax Type Transfer

- Requests can be Approved/Rejected for each return type

Adding Taxpayers

Adding taxpayers (Current)

Adding Taxpayers (New)

Request Tax Types (Current)

Manage Tax Types (Activations and Requests)

Manage Tax Type Transfers

Transfer Approvals