Menu

Have you received an Auto Assessment from SARS?

If you were auto-assessed, you would have been notified per SMS in July – so there would be no need for you to call us or visit a branch.

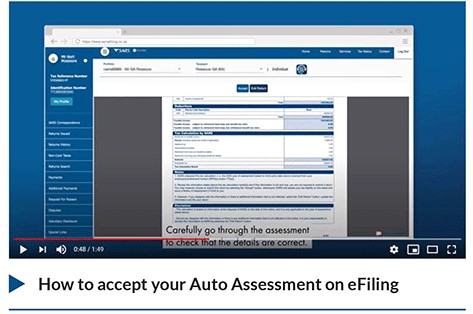

The SMS directs you to eFiling or the SARS MobiApp to either ‘Accept’ or ‘Edit’ the return.

We auto-assess based on data we receive from employers, financial institutions, medical schemes, retirement annuity fund administrators and other 3rd party data providers.

If you accept the results of your auto-assessment and if there is a refund due to you, the refund will be paid by SARS. A negative amount indicates that a refund is due to you.

If you owe SARS money, you can make a payment on eFiling, via EFT or the SARS MobiApp by the specified due date on your Notice of Assessment. See our 2020 Filing Season webpage for more information.

Additional FAQs and information regarding specific errors can be found on our SARS website ‘How does the Tax Calculation work?’

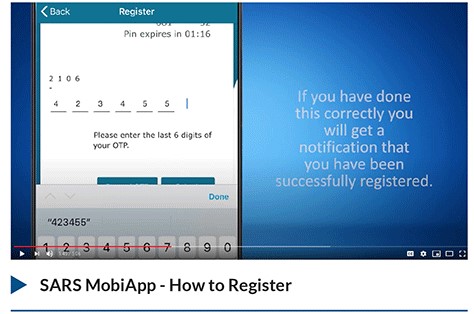

Not registered on eFiling or the SARS MobiApp?

Watch our helpful videos explaining how to register on either of the above platforms.

Information on the appointment process, can be found on the eBooking webpage.