How to request a Turnover Tax Return

- By visiting a SARS branch

- By completing the TT03 form online

How to submit the return

- Book an appointment to visit the nearest SARS branch or

- Post it to SARS as TT03’s are processed at SARS Doringkloof, Centurion:

- PO Box 436, Pretoria, 0001

When to submit the return

The submission of TT03 turnover tax returns is in line with the submission of the annual income tax returns, between 1 July and 31 January of the following year.

How to complete the return

- Year of Assessment

- Turnover Tax reference number

- Surname/Registered name

- First names

- Identity Number

- Initials

- Cell Number

- Passport Number

- Date of Birth (CCYYMMDD)

- Home Telephone Number

- Business Telephone Number

- Fax Number

- Account Number

- Branch Number

- Account Type

- Bank Name

- Account Holder Name

- Year of Assessment

- Turnover Tax reference number

- Registered name

- Trading name

- Financial Year End (CCYYMMDD)

- Account Number

- Branch Number

- Account Type

- Bank Name

- Account Holder Name

- Suburb/District

- City/Town

- Postal Code

- Street/Name of Farm

- Country Code

- Individual – if you are a sole proprietor or a partner in a partnership

- Company – if completing for a close corporation, company or co-operative

First two names: This is a mandatory field that must be completedSurname: This is a mandatory field that must be completedInitials: This is a mandatory field that must be completed with your full initials.Date of birth: This is a mandatory field that must be completedIdentity number: You must complete this field if you are a South African residentPassport number: This number must only be completed if you do not have an identity numberPassport Country: This field will be pre-populated with “ZAF”, representing South Africa. If this is not applicable, change to the relevant country. Refer to the list of country codes:

Contact telephone numbers

Contact email

Spouse details: These fields are mandatory if you have indicated your marital status as “married in community of property”.

If “Company” is selected as a taxpayer type the following information must be completed:

Registered name: The name that appears on your Companies and Intellectual Property Commission registration certificate.

Trading name

Company/Close registration number: the number as per the Companies and Intellectual Property Commission registration certificate

Financial year end: this must be captured as year, month and day (CCYYMMDD).

Note that your financial year end must be 28 February.

Bank account details:

It is imperative that you ensure that your bank account details are correct as refunds will be delayed if the bank details are not provided or are incorrect.

If you do not have a local bank account (cheque or savings/transmission), place an “X” next to the applicable field.

The “No local Saving/Cheque Bank Account Declaration” fields and “Reason for no Local Savings/Cheque bank account” fields becomes mandatory:

- Select the relevant reason for no bank account details

- Place “X” on the “Agreement Statement” check box to declare that the information provided for non-local bank account is true and correct.

If you do have a local cheque or account savings/transmission, the relevant fields become mandatory and must be completed.

Where your banking details have changed from the previously details, presentation of supporting documents in person by the individual or entity’s representative is needed, refer to Bank Detail changes below. The supporting document must be submitted at the nearest SARS branch.

The following fields are mandatory:

- Account number

- Branch number

- Account type

- Account holder name

- Bank name

- Branch name.

If neither the tick box nor banking details are completed, the return will be sent back to you as incomplete.

Note: SARS will not pay a refund into an account of a third party.

Bank detail changes

With effect from 1 July 2011 the process to change banking details must go through verification:

Where you are requesting banking details to be changed on your TT03, you must visit your nearest SARS branch in person to verify and change of banking details.

Should you need any further information about banking detail changes, you can:

- See the Change in Banking details page

- Visit your nearest SARS branch

- Call the SARS Contact Centre on 0800 00 SARS (7277) for assistance, they will not be able to change your banking details for you.

Address information

If your residential/physical/registered address and postal address are the same, it is not necessary to repeat the address details in the postal address section. However, you need to mark the box showing that the addresses are the same.

Please note the address information must be the individual or entity’s specific details and not the details of another person such as a tax practitioner who completed the return.

Tax practitioner details

If the services of a tax practitioner issued to complete the return, this information must be completed by the tax practitioner.

Taxpayer’s signature and declaration

The TT03 is a legal declaration to SARS declaring the total receipt that the taxpayer has received during a specific tax year.

- The owner or legal representative is obliged to ensure that a full and accurate disclosure is made of all relevant information as required in the TT03. Misrepresentation, neglect or failure to submit a return, or supplying false information can give rise to interest, penalties and/or additional tax and/or prosecution.

- After completion of the return, the owner or legal representative must read the declaration of the return and sign.

- Please note if a return is submitted to SARS without being signed, it will be returned and be regarded as out¬standing. This could result in further penalties for the late submission of the return.

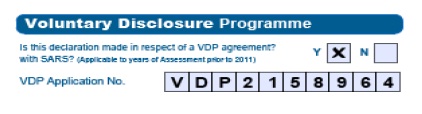

Voluntary Disclosure programme (VDP)

Where an approved VDP agreement exists between yourself and SARS, make sure that you have:

- Insert an “X” in the “Y” box

- Completed the VDP application number.

For more information on VDP, read here.

Public Officers particulars

Complete this section if “Company” was selected as a taxpayer type. The following fields must be filled in:

- Surname

- Initials

- Cell number

- Identity Document number

- Date of Appointment

- Email address

Address for legal purposes

Complete this section if “Company” was selected as a taxpayer type and the address where you would like us to send to, if the legal information is different to the physical and registered address. The following fields must be captured:

- Unit no

- Complex (If applicable)

- Street number and name or name of farm

- Suburb/District

- City/Town

- Country code – refer the list of country codes

- Postal code

Turnover tax calculation

The taxable turnover will be used to determine the final tax liability for the year of assessment.

Individuals

Select the relevant type of business

- Sole proprietor, if you an individual running your own business

- Partnership, if you an individual in a partnership.

- If partnership, state taxpayer’s share of the partnership as a percentage

Sole proprietor

Determine the total amounts you get from business activities excluding investment income and capital receipts (e.g. sale of business assets)”.

Top tip: Investment income is generally income in the form of interest, dividends, rental income, royalties and annuities, proceeds from the sale of shares for example This income will be taxed by the individual/sole proprietor as per the normal Income Tax rules and an Income Tax return (ITR12) is needed to declare the investment income separately. This will allow the indi¬vidual/sole proprietor to access the Income Tax exemptions for interest and dividends.

Determine “Inclusions” to be declared on the TT03 as follows:

50% of sales of business assets

- Determine the total of the sales of business assets that were mainly used for business purposes for the year of assessment. Where the business asset is immovable property, only include that portion of the sale that can be attributed to the part of the property that was used for business purposes. Calculate 50% of the total of the sale of business assets and add it to the gross receipts.

- Determine “Exclusions” to be declared on the TT03 as follows:

Turnover from business activities carried on outside South Africa

- Determine the total of the sales from business activities outside South Africa for the year of assessment and deduct this from the gross receipts.

Government grants

- Determine the total of Government grants you received for the year of assessment and deduct this from the gross receipts. These are grants that are specifically exempted from Income Tax and can be broadly categorised as scrapping grants, export grants, and Small/Medium Manufacturing Development Program grants.

Amounts previously subjected to Income Tax

- Amounts that were previously subjected to Income Tax should not be taxed again and should therefore be deducted from the gross receipts.

Refunds paid or received in respect of goods and services

- Credit notes: for example damaged goods returned.

Taxable Turnover

- The turnover tax liability of the business for the year of assessment will be worked out by SARS by applying the appropriate tax rate from the turnover tax table.

Amount received from rendering Professional services

- In the case of natural persons, if more than 20% of total receipts are received from the rendering of a professional service, you will not qualify for turnover tax and you will be taxed under the normal Income Tax system effective from 1 March 2011.

- Indicate whether you are in receipt of any income other than trading income:

- An ITR12 must be submitted with the TT03 if yes was selected. If you need to know more about how to submit an Income Tax Return (ITR12), see our example.

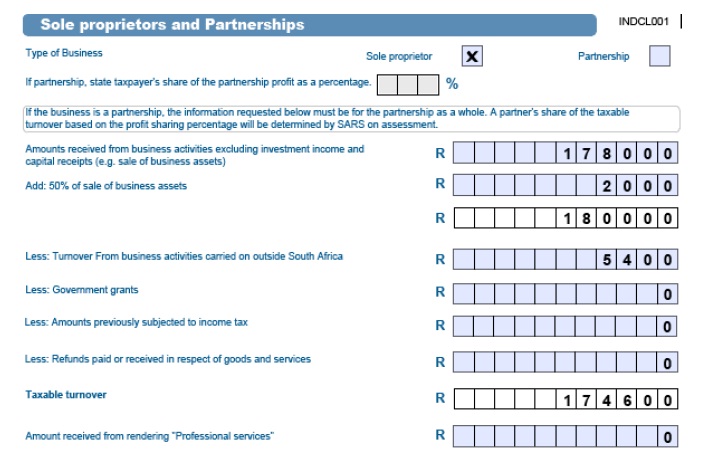

Example: A sole proprietor, who received the following amounts for the year of assessment:

- Sales R178 000

- Sales of business assets – sewing machine R 4 000

- Interest from the business bank account R 1 000

- Turnover from business activities carried outside SA R 5 400

The form would look like this:

Taxable turnover for the year of assessment will be determined as follows:

The taxable turnover of R174 600 will be worked out by SARS. According to the turnover tax tables, the Turnover Tax payable on R174 600 is R264 (R174 600 less R150 000 x 1%). Assuming that the taxpayer made interim payments of R100 in August and R164 in February, her assessment will show that the amount owing, after taking the interim payments into account, is nil (R264 less R100 less R164).

The ITR12 must be submitted to declare the R1 000 interest but will be exempt from tax since it is below the exempt interest threshold. ITR12 must be submitted with the TT03. If you want to know more, read about how to submit an ITR12.

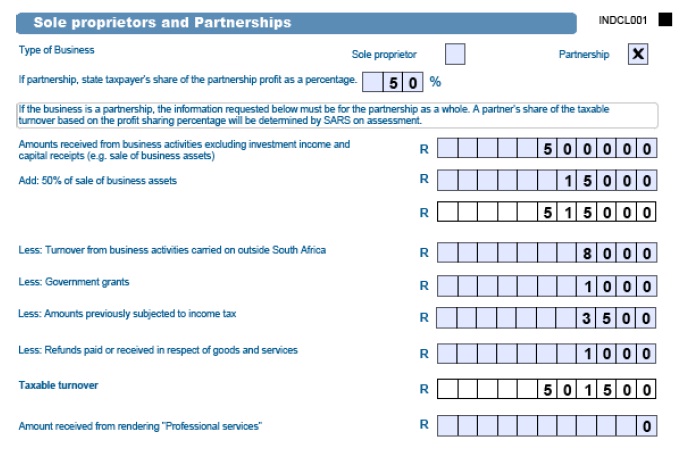

Partnerships

The process is the same for sole proprietors except that the final taxable turnover of the business will be apportioned and taxed in the hands of each partner based on the profit sharing ratio as per the partnership agreement. The total turnover of the business must therefore be declared.

Example: Two brothers are partners in an electronic equipment repair business. They share the profits of the business equally, do not have any other business interests, and were never registered for Income Tax previously. Their business got the following amounts for the year of assessment:

-

Amounts from repairs R500 000

-

Sales of business assets – repair equipment R 30 000

-

Interest from the business bank account R 2 000

-

Rental from a portion of their property R 6 000

-

Amount received due to business activities in Australia R 8 000

-

Grant received from government R 1 000

-

Amounts received but taxed in previous years R 3 500

-

Credit note R 1 000

Their taxable turnover for the year of assessment will be determined as follows:

Since this is a partnership, the taxable turnover will be taxed for each partner based on the profit sharing percentage the partners share, in this case equally so each partner will be taxed as follows:

The taxable turnover of business X profit sharing % (R501 500 x 50%) R250 750. The tax of each partner on taxable turnover per tables R1 007.50 (R250 750 less R150 000 x1%). Assuming that the each partner made interim payments of R503.75 in August and R503.75 in February, his/her assessment will show that the amount owing, after taking the interim payments into account, is nil.

Top tip: The interest of R1 000 (R2 000 x 50%) will be taxed according to the normal Income Tax rules but will be exempt from tax since it’s below the exempt interest threshold. The rental income of R3 000 (R6 000 x 50%) will be taxable in his/her hands.

Indicate whether you are in receipt of any income other than trading income:

-

ITR12 must be submitted with the TT03 if yes was selected. See how to request and submit an Income Tax Return (ITR12).

Close corporations, companies and cooperatives

Select the relevant type of business

-

Company

-

Close Co-operation

-

Co-operative.

Work out “Total amounts received from business activities excluding investment income and capital receipts (e.g. sale of business assets)”.

-

This is the total of amounts you got from business activities in South Africa. This amount will be referred to as gross receipts for working out the taxable turnover.

-

Investment income is generally income in the form of interest, dividends, rental income, royalties and annuities.

Adjust the gross receipts by adding:

“50% of sales of business assets”

-

Work out the total of the sales of business assets for the year of assessment. Where the business asset is immovable property, only include that portion of the sale that can be attributed to the part of the property that was used for business purposes. Calculate 50% of the total of the sale of business assets and add it to the gross receipts.

-

“Investment income (except local and foreign dividends)”

Investment income like interest, rental income, annuities and royalties received by the business must be added to gross receipts.

Adjust the gross receipts by deducting the following:

Turnover from business activities carried on outside South Africa

-

Work out the total of the sales from business activities outside South Africa for the year of assess¬ment and take this away from the gross receipts.

Government grants

-

Determine the total of Government grants you got for the year of assessment and take this away from the gross receipts. These grants are specifically exempted from Income Tax and can be broadly categorised as scrapping grants, export grants and Small/Medium Manufacturing Development Program grants.

Amounts previously subjected to Income Tax

-

Amounts that were previously subjected to Income Tax should not be taxed again and should therefore be deducted from the gross receipts.

Refunds paid or received in respect of goods and services

-

Credit notes: for example damaged goods.

Taxable turnover

-

The taxable turnover will be used to assess the Turnover Tax liability of the business for year of assessment.

-

The only difference from individuals and partnerships is that investment income (interest, rentals, annuities and royalties), with the only exception of Local and Foreign dividends, will be included in full in the taxable turnover of the Company/Close Corporation/Co-operative.

-

The process for determining the taxable turnover for Close Corporations, Companies and Cooperatives is summarised in the following table:

The total “Amount received from professional services” rendered during the year of assessment must be stated on the return.

-

If more than 20% of total receipts are received due to investment income and the rendering of a professional service, the company doesn’t qualify for the turnover tax regime and must be taxed under the normal Income Tax system effective from 1 March 2011.

-

Indicate the amount of “Dividends declared for the year of assessment” by the company.

-

Investment income excluding dividends is included in taxable turnover.

-

The first R200 000 is exempt from dividends withholding tax, however, any amount in excess of R200 000 will be subject to the dividends withholding tax.

-

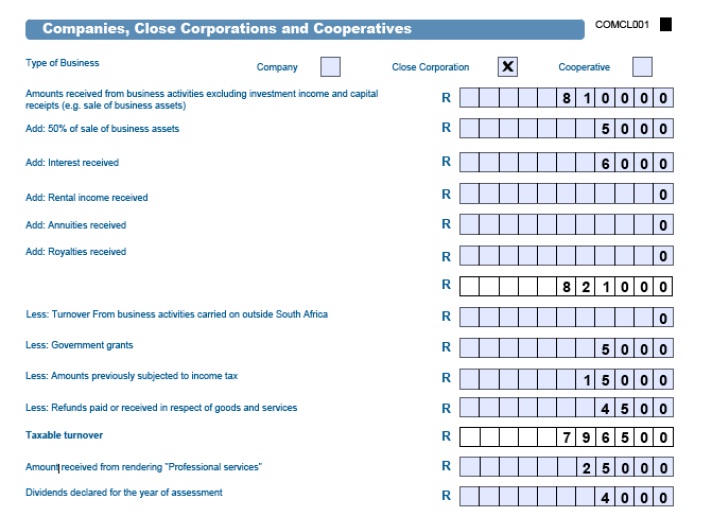

Example: Micro CC is a close corporation with five members. Its main business is the sale and distribution of computer hardware and software in South Africa and to neighbouring countries. On a small scale, it also offers its clients a computer repair service. After being on the Income Tax register for a while, Micro CC decided to register for the Turnover Tax. The business received the following amounts for the year of assessment:

-

Amounts from sales in South Africa R685 000

-

Amounts from sales outside South Africa R100 000

-

Amounts from services and repairs R 25 000

-

Government grant that is exempt from income tax R 5 000

-

Sales of business assets – packaging machine R 10 000

-

Dividends from investments in another company R 4 000

-

Interest from the business bank account R 6 000

-

Credit note R 4 500

-

Amounts previously subjected to income tax R15 000

Note:

-

The credit note relates to a refund received by Micro CC for faulty equipment that was returned to the supplier.

-

The sales figure includes an amount of R15 000 received from a client in South Africa for a contract concluded in the previous year of assessment. The R15 000 had accrued to Micro CC in the previous year of assessment and was subject to normal Income Tax

-

The amount for services and repairs constitutes professional services

Determine taxable turnover:

Sales in SA R685 000

Add: Sales outside SA R100 000

Professional Services R 25 000

Total amounts received R 810 000

Below is their form:

-

The taxable turnover of R796 500 will be assessed by SARS.

According to the Turnover Tax tables, the Turnover Tax payable on R796 500 is R18 290 (R15 500 + 6% of amount above R750 000 of R796 500 = R2 790).

Assuming that the taxpayer made interim payments of R10 000 in August and R7 290 in February, the assessment will show that the amount owing, after taking the interim payments into account, is R1 000 (R18 290 less R10 000 less R7 290). -

As the total “Amount received from professional services” rendered during the year of assessment is less than 20% of total receipts the company will qualify for the turnover tax regime, effective from 1 March 2011.

-

As the first R200 000 is exempt from dividends withholding tax, the R4 000 will not be subject to the dividends withholding tax.