Menu

How to register for Turnover tax?

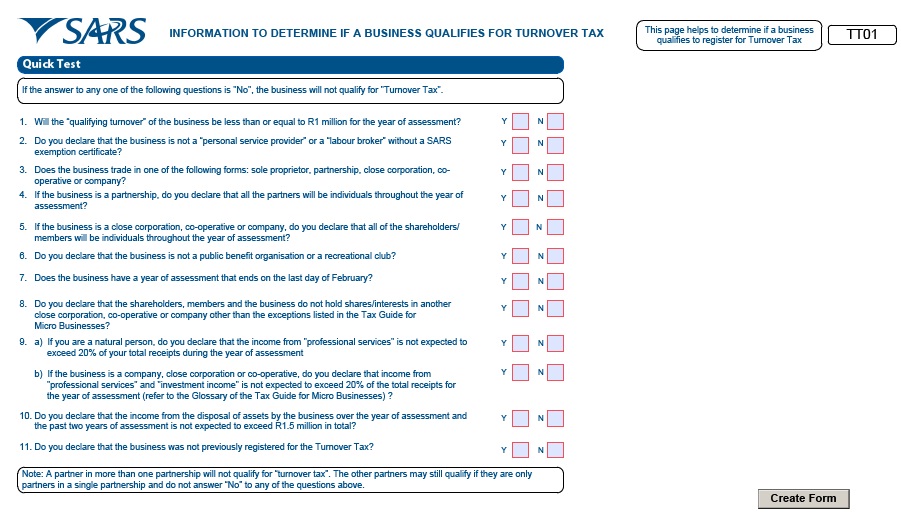

- Do a quick test to see if you quality for turnover tax

- If you qualify, fill in a TT01 application form:

Top tip: Irrespective of whether the TT01 is completed manually or online, you will still have to print it after completion and take it to a SARS Branch or send by post to your nearest region.

When should an application for registration be submitted?

It should be sent before the beginning of a year of assessment (a year of assessment runs from 1 March to 28 February), or a later date that may be determined by the Commissioner in a Government Notice.

The timing differs slightly for new registrations and existing registered businesses:

- New businesses: Should a new micro business start trading during a year of assessment and wishes to register for turnover tax, an application must be sent within two months from the date that the business started.

- Existing businesses: existing micro businesses can register for or switch to turnover tax before the start of a new tax year.

You can submit your completed TT01 form using the following channels:

- Book an appointment to visit the nearest SARS branch or

- Posting the return to SARS Processing centre:

- PO Box 436, Pretoria, 0001

SARS will send you a letter about the outcome of the application. Where the submitted TT01 form is incomplete, the taxpayer will be informed and the application will be re-considered once all of the information has been provided.

How does deregistration work?

- Voluntary deregistration: A person may elect to voluntary de-register before the beginning of a year of assessment or a later date announced by the Commissioner in a Government Notice. Deregistration will be effective from the beginning of that year of assessment.

- Compulsory deregistration: You may be forced to deregister if your turnover exceeds R1million for a given tax year or certain qualifying criteria are no longer met (paragraph 3 of the Sixth Schedule). In the case of a compulsory deregistration, the business will be deregistered from the beginning of the month following the month during which they no longer qualify for turnover tax.

Top Tip: If a person has been deregistered (voluntary or compulsory) from turnover tax, they may not be registered as a micro business again.

How to complete the TT01 form?

When opening a TT01 application form, you will be required to complete the Quick Test before the form opens up further.

If the answer to any of the Quick Test questions is “No”, the business will not

qualify for Turnover Tax.

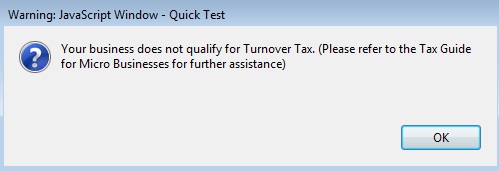

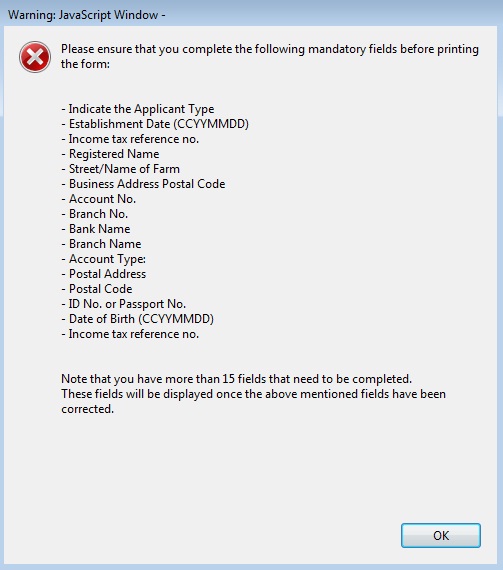

If the Quick Test is not completed correctly the following error message will appear:

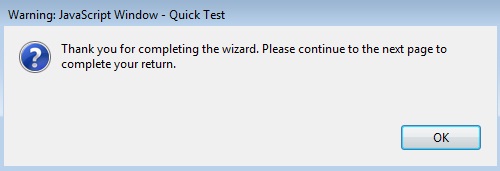

On completion of the Quick Test click “Create Form” and the following message will appear:

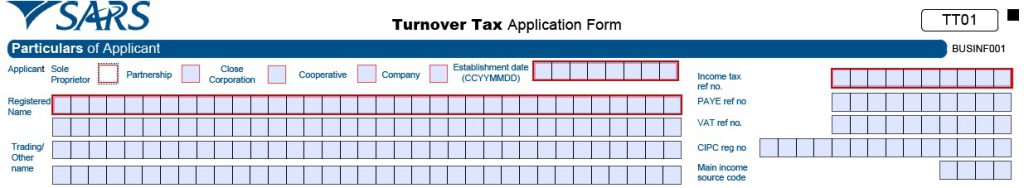

Particulars of applicant

Indicate whether the applicant is a:

Sole proprietor (individual)

Partnership

Close Corporation

Co-operative or

Company

by ticking the appropriate box.

Failure to tick any of the boxes will result in the rejection of your application.

Establishment date

This is the date on which the business was started. Please ensure that the CCYYMMDD format is used

e.g. 20020601 for a business that started trading on 01 June 2002.

Registered name

This is the name that the business is legally registered under with the relevant authority e.g.

This is a mandatory field only if the close corporation, co-operative or company box at the top of the form is ticked.

Trading/other name

This is the name under which the business trades or by which it is generally known to its customers.

Income Tax reference number

This is the registration number that a business obtains from SARS when it registers for Income Tax.

Pay-As-You-Earn (PAYE) reference number

This is the registration number that a business obtains from SARS when it registers for PAYE.

Value-Added Tax (VAT) number

This is the registration number that a business obtains from SARS when it registers for VAT.

CIPC registration number

This is the registration number that a close corporation, co-operative or company obtains when it

registers with CIPC (Department of Trade and Industry).

Main income source code

This is the code for a specific sector in the economy e.g. manufacturing, from which the businesses

main income is derived. The codes for the various sectors in the economy can be found in Annexure A

below.

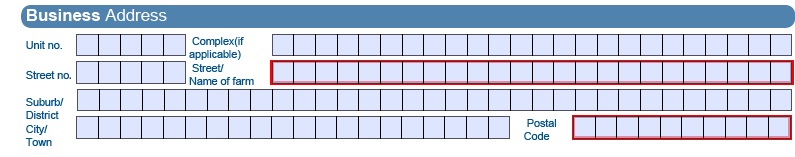

Business Address

This is the physical address of the business i.e. the premises the business is trading from.

If the business is trading from a flat or townhouse, the actual flat or townhouse unit number must be

inserted in “unit no”

The name of the block or the block of flats or townhouse complex must be inserted in “complex” and

Where the business does not trade from a flat, townhouse or complex these fields are left blank.

Street no

Street/Name of farm

Suburb/District

City/Town and

Postal code.

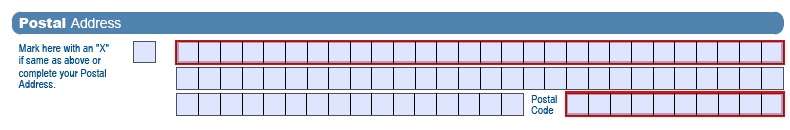

Postal Address

This is the address that the business would like its post to be sent to. It may be the same as its business address above or it may be a post box number or other address. If it is the same as the business address simply mark the relevant box with an “X”.

If the answer is “No”, the following fields will be displayed as open and editable:

Postal Agency or Other Sub-unit (if applicable) (e.g. Postnet Suite ID)

PO Box: Indicate on the applicable tick box if the postal address is ‘P.O. Box’ or ‘Private Bag’

Private Bag: Indicate on the applicable tick box if the postal address is ‘P.O. Box’ or ‘Private Bag’

Other PO Special Service (specify)

Number

Post Office

Postal Code

Registered Postal Address indicator

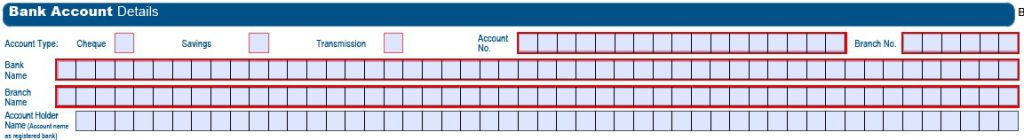

Bank Account Details

These are the particulars of the bank account that will be used by the business.

Account No

Note: The following fields must be completed after the selection of the Bank Name.

Branch No: If the ‘Bank Name’ has a universal bank code, this field will be locked and default to the

universal branch code, else this field will be editable and must be completed

Branch Name: If the ‘Bank Name’ has a universal bank code, this field will be locked and default to

“Universal branch”, else this field will be editable and must be completed.

Account Type – Select Cheque or Savings/Transmission

Account Holder Name (Account name as registered at bank) – Bank Name: Click on the + sign for the

list of bank names to be displayed and a selection to be made. Click the “OK” button to continue.

Account Holder Name

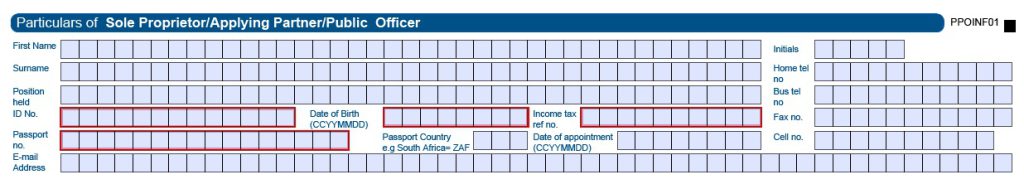

Particulars of Sole Proprietor/Applying Partner/Public Officer

The following particulars are required:

Sole proprietorship: details of the sole proprietor or individual.

Partnership: Details of the partner applying for the Turnover Tax. Where two or more partners are

applying for the Turnover Tax each partner must complete a separate application form.

Close corporation: Details of the public officer of the close corporation.

Company: Details of the public officer of the company.

Co-operative: Details of the public officer of the co-operative.

The Income Tax reference number and date of appointment of the persons listed must also be supplied.

Please note:

All the fields in this section are mandatory. However, the applicant can provide either his/her ID

number or a passport number i.e. both need not be provided. He or she must also provide at

least one contact phone number.

Where there are two or more Partners/Members/Shareholders they must complete the following

fields per Partners/Members/Shareholders:

First name

Initials

Surname

Home tel no

Position held

Bus tel no

ID no

Date of birth (CCYYMMDD)

Income tax ref. no

Fax no

Passport no

Passport country (e.g. South Africa = ZAF)

Date of appointment (CCYYMMDD)

Cell no and

Email Address.

Particulars of Three Partners/Members/Shareholders

Where there are two or more partners/members/shareholders they must complete the number of partners/

members/shareholders.

Particulars of Partners/Members/Shareholders

Complete the following fields for partners/members/shareholders:

First name

Initials

Surname

Income Tax ref. no

ID no

Passport no

Passport country (e.g. South Africa = ZAF)

If attempting to print the TT01 form without completing the mandatory fields a pop – up message will be

displayed:

If the form is not to be submitted immediately due to uncertainty about necessary details or there is a need to

restart capturing the form; the following options are available:

Click “Save” to capture necessary information at the later stage

Click “Reset” to restart capturing the return or

Click “Print” to print the form to sign and submit to SARS.

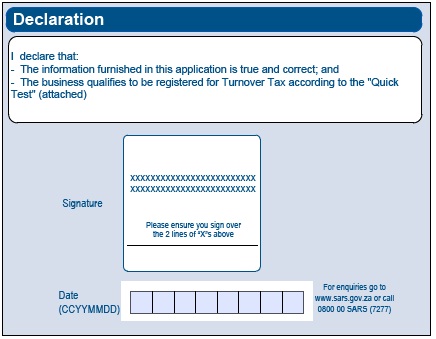

Declaration

Once all the information has been completed the applicant is required to complete, print and sign on the first page of the application form. Failure to do so will result in the application being rejected.

How to submit?

The completed TT01 application form must be submitted at a SARS branch or by post to your nearest region.

The eFiling option is not yet available for submission of the TT01 application form.

To access this page in different languages click on the links below:

- Afrikaans

- IsiZulu

- Sepedi

- Sesotho

- Xitsonga