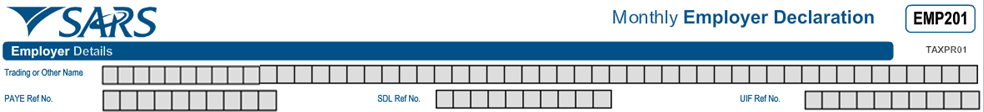

1. EMPLOYER DETAILS

- The Employer Details will be pre-populated. Check your information is correct.

Top Tip: All fields are mandatory.

- Trading or Other Name – The trading name is the name under which your business trades. It may be different from your business’ legal name.

- PAYE Ref No. – The reference number must start with a ‘7’.

- SDL Ref No. (if applicable) – The reference number must start with an ‘L’.

- UIF Ref No. (if applicable) – The reference number must start with a ‘U’.

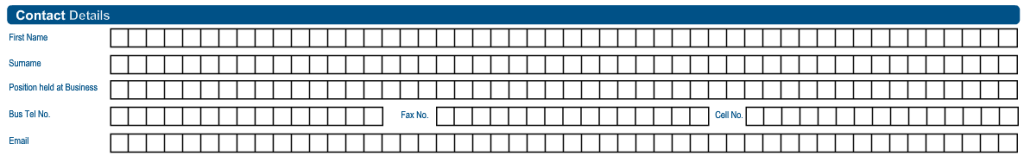

2. CONTACT DETAILS

- The details of the representative taxpayer responsible for the declaration must be filled in here.

- First Name and Surname – These are mandatory fields.

- Position held at Business – This is a mandatory field.

- Bus Tel No. or Cell No. – This is a mandatory field. Either the business telephone or cell phone number must be filled in.

- Fax No. –This is an optional field.

- Contact email – This is an optional field.

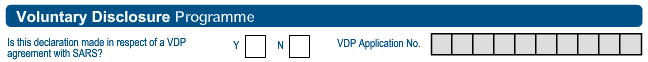

3. VOLUNTARY DISCLOSURE PROGRAMME

- Where an approved VDP agreement exists between the company/CC and SARS, mark an “X” in the “Y” box and provide the VDP application number.

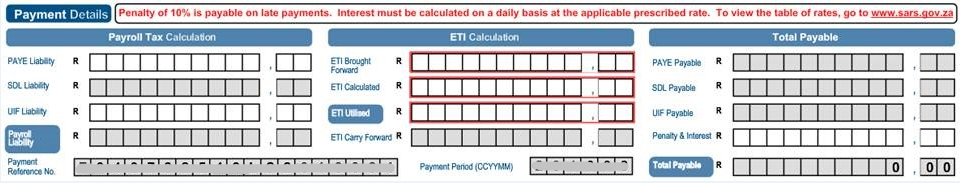

4. PAYMENT DETAILS

Top Tips:

- All details are mandatory

- In the case of NIL declarations, enter the amount(s) “0”.

- Three new sub-sections have been included:

- Payroll Tax Calculation – your monthly payroll tax due

- ETI Calculation – only if all the criteria and requirements have been met, are you allowed to claim for the Employment Tax Incentive. See if you qualify.

- Total Payable – the amount due to SARS, if applicable.

1. Payroll Tax Calculation

- PAYE Liability – Complete the total amount that must allocated for PAYE.

SDL Liability – Complete the total amount that must be allocated to SDL.

UIF Liability – Complete the total amount that must be allocated to UIF.

Payroll Liability – This amount will automatically be calculated. It is the sum of PAYE plus SDL plus UIF due.

2. ETI Calculation

Top Tip: An employer who has outstanding returns or owes money to SARS on the last day of the month won’t be allowed to claim the ETI, unless the employer has entered into an agreement with SARS.

- ETI Brought Forward – Complete the amount carried forward (ETI Carry Forward amount) from the previous month.

Please note:

- The brought forward amounts for March (period 03) and September (period 09) must always be zero (0).

- An excess amount may be carried forward to the next month, when the ETI:

- Is more than the PAYE due for a particular month.

- Was available, but hadn’t been deducted from PAYE for a particular month.

- Where the employer isn’t allowed to claim ETI due to non-compliance, e.g. outstanding returns or debt, etc., this allowable amount may be carried forward to a future period once the employer is compliant again.

Top Tip: An employer will be given six months to correct any non-compliance, allowing them to still claim the ETI entitlement during that reconciliation period. If the employer is still non-compliant by the next reconciliation period, the employer won’t be allowed to claim the ETI entitlement (for the previous reconciliation period) and this amount will be lost.

- ETI Calculated – Complete the total amount of ETI you are entitled to for the particular month.

Top Tip: See more information on How does the Employment Tax Incentive (ETI) work .

- ETI Utilised – Complete the total amount of ETI to be used for the particular month.

Top Tips:

- If the ETI Utilised is more than your PAYE liability in a particular month, the nett PAYE will be zero (R0), i.e. the nett PAYE can’t be a negative amount resulting in a credit.

- This amount can’t be more than ETI Brought Forward plus the ETI Calculated for the particular month.

- If an employer is non-compliant, the ETI Utilised amount may only be used in the month in which the employer becomes compliant again and mustn’t be backdated.

- ETI Carry Forward – This amount will automatically be calculated. This will be the next month’s ETI Brought Forward amount to be completed and is the ETI Brought Forward plus the ETI Calculated less the ETI Utilised.

- Payment Reference No. – This number is created by SARS and will be filled in when the EMP201 is issued.

- Payment period – This field will be filled in by SARS with the relevant PRN for the period.

3. Total Payable

- PAYE Payable – This amount will automatically be calculated. It is the PAYE Liability less the ETI Utilised.

- SDL Payable – This amount will automatically be calculated.

- UIF Payable – This amount will automatically be calculated.

- Penalty & Interest – Complete the total amount that must be allocated to penalties & interest for that specific month.

Top Tips:

- This amount should be the same as the amount shown on the Employer Statement of Account (EMPSA).

- An employer who receives the ETI for an employee that doesn’t qualify, will pay a penalty of 100% of the ETI you got for that employee.

- Total Payable – This amount will automatically be calculated.

5. EMPLOYMENT TAX INCENTIVE (ETI)

In order to claim the ETI, a requirement which must be met is that the employer doesn’t have any outstanding declaractions or debt with SARS.

Complete either Y or N.

Top Tip: If N is selected, a warning message will appear advising that you won’t be allowed to claim the ETI.

6. TAX PRACTITIONER DETAILS (if applicable)

- If a tax practitioner completes and submits the EMP201, this section must be filled in:

- Registration number

- Telephone number.

7. DECLARATION

- This section is mandatory and must be filled in.