The merge function is available on eFiling. This function will help individual taxpayers, Registered Representatives of entities and Tax Practitioners to easily merge all the types of taxes for example Income Tax and Employees’ Tax as well as Customs & Excise into one single profile for each client/entity.

Top Tip: A representative may act on behalf of a taxpayer in exceptional circumstances, e.g. a parent on behalf of a minor child or an executor on behalf of an estate. The merging of taxes under a single profile should only be performed once. Any new registration will then be linked to the single client/entity profile.

Updating of registered details must still be done on the Registration Amendments and Verification Form RAV01.

How to activate merging?

Top Tip: Merging can’t be done e@syFile™. You need to first activate the merging before doing the actual merging. Registered Representatives and Tax Practitioners will need to activate the eFiling merge function for each client/entity profile, before it can be used. Individual taxpayers will be automatically activated. The activation must be done:

- even if you’ve been activated on eFiling before.

- once per client, which will then enable you to merge all types of tax and update registered details.

Activation for Registered Representatives

Step 1: Activate the merging on eFiling

Go to the Organisation profile and click on ‘Activate Registered Representative’ under ‘SARS Registered Details’:

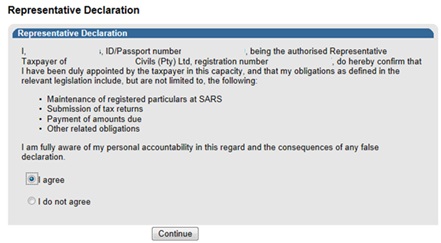

The Representative Declaration will be shown. Read this carefully.

Step 2: Select ‘I agree’ and click ‘Continue’

Step 3: Fill in your tax reference number under eFiling ‘User Details’ and click ‘Activate Registered Representative’.

Top Tip: Once the activation has been approved, rights can then be given to other users to submit new registrations, but only the Registered Representative can use the merge function.

Activation for Tax Practitioners

You will automatically be given access to the merge function, if you have previously activated yourself as the Registered Tax Practitioner on a client/entity profile.

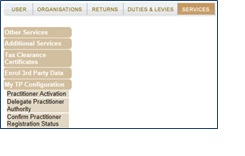

Step 1: Go to ‘Services’, click on ‘My TP Configuration’ and then ‘Practitioner Activation’

The ‘Tax Practitioner Declaration’ will be shown. Read this carefully.

Step 2: Select I agree and click ‘Continue’

Top Tip: Once the activation has been approved, rights can be assigned to other users to use the merge function.

Completing the activation process

For Registered Representatives to complete the activation, you will need to send the following supporting documents (relevant material) depending on the nature of the entity:

| Nature of Entity | Capacity | Appointed By | Supporting document (relevant material) for appointment |

| Individual | Representative | N/A | Identity Document (e.g. ID, Passport) |

| Company | Public Officer | Board of Directors | · Representative Appointment · Notice of Incorporation |

| Trust | Main Trustee | Board of Trustees | · Letter of Authority · Trust Deed |

| Government Public Owned Entity State Owned Entity | Accounting Officer | Government Gazette | Representative Appointment |

| Political Party | Treasurer | Representative Appointment | |

| Club | Treasurer | Committee | Representative Appointment |

| Association not for gain Welfare Organisation | Accounting Officer | Representative Appointment | |

| Partnership Body of Persons | Accounting Officer | Partners | · Representative Appointment · Partnership Agreement |

Top Tip: It could take up to 21 business days for the documents to be authenticated and reviewed. The activation will either be approved or rejected.

Another Top Tip: Where the activation request has been rejected, you will need to visit a SARS branch to have yourself confirmed as the Registered Representative. Once the activation has been approved:

- You will automatically be recorded as the only Registered Representative on the SARS system for the client/entity.

- Any previously activated Registered Representative/s access will be lost. A notice will either be sent to their eFiling profile or by email.

How to merge the taxes?

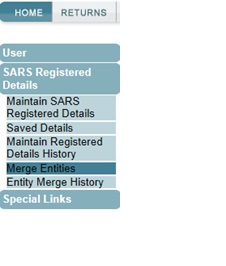

Once the merging was activated, select ‘Merge Entities’ under SARS Registered Details:

You will be directed through a five step process to make sure all the types of tax are linked to the correct client/entity:

Step 1 – Select the Registered Representative for the client/entity

This will only be relevant to Tax Practitioners.

Top Tip: For individual taxpayers, Companies and Trusts only one option will be available for selection.

The Registered Representative details must be provided and not the Tax Practitioner’s.

A Registered Representative is a person who is appointed with full rights to act on behalf of another legal entity and isn’t normally a Tax Practitioner.

Top Tip: An exception would be, for example, where a Tax Practitioner has been chosen as the Public Officer etc. of a company and also works as a Tax Practitioner for other clients.

The Tax Practitioner must confirm with the client who the Registered Representative should be, before making the selection on eFiling.

The supporting document (relevant material) of the Registered Representative must be sent to SARS.

Once the activation has been approved:

- The Registered Representative will automatically be recorded as the only Registered Representative on the SARS system for the client/entity.

- Any previously activated Registered Representative/s access will be lost. A notice will either be sent to their eFiling profile or by email.

Step 2 – Main records

Select the main entity registration to which all other registrations will be linked for example Income Tax to which VAT will be linked.

Top Tip: The most up-to-date record should be used.

Step 3 – Additional records

Add all other types of tax which should be linked to the client/entity.

Top Tip: Complete all the mandatory fields, which will be shown in red.

Step 4 – Review

Review all the information is correct, before sending the request to SARS. Make sure all client details, tax reference numbers etc. have been completed.

Step 5 – Submit

Complete the declaration and send the request to SARS.

Top Tip: You will need to visit a SARS branch where an incorrect tax reference number has been linked to a client/entity profile. This can’t be removed on eFiling. For a more information, see the Step by Step guide to the Entity Merge Functionality on eFiling – External Guide.

Need help?

- Call the SARS Contact Centre on 0800 00 SARS (7277).