- The EMP201 allows you to adjust an earlier submitted declaration or reallocate credits, whether it is for this period or prior period, for Pay-As-You-Earn (PAYE), Skills Development Levy (SDL), Unemployment Insurance Fund (UIF) and/or Employment Tax Incentive (ETI).

- The ETI is an incentive aimed at encouraging employers to hire younger work seekers. It was implemented with effect from 1 January 2014 and can be claimed for a period of 24 months from the date of employment.

- The ETI is in operation from 1 January 2014 till 28 February 2019.

- Certain criteria and requirements must be met, to qualify for the ETI.

- The penalty and interest fields on the EMP201 shows the portion of the payment that must be allocated to penalty and/or interest. Therefore be sure to include these amounts in addition to the monthly liability that’s due .

- You’re responsible for administering your own tax account. So when a payment is made, you must make sure the payment details shown are correct. The Payment Reference Number (PRN) and the allocation of the payment must be correct for PAYE, SDL, UIF and/or ETI on the EMP201 you fill in.

- You are provided with a consolidated view of all three of the payment taxes. On receipt, payments are stored in your clearing account, which is then automatically allocated to PAYE, SDL and/or UIF inline with your submitted EMP201.

- Any under or over-payment is easily identified by SARS, and you are told. This makes it easier for you to put right correct an allocation declared or move a missing allocation in the right place.

Top Tip: The EMP201 will no longer be posted to employers. Manually completed Payroll Tax forms dropped off at a SARS branch (in the drop-box) or posted, are no longer accepted.

You can get an EMP201 by:

- Accessing e@syFile™ Employer

- Accessing eFiling

- Visiting a SARS branch, where an agent will help to fill in the EMP201 electronically.

Please note:

-

- An EMP201 printed from eFiling/e@syFile™ Employer and sent to SARS won’t be accepted.

- A payment can’t be made without first submitting the EMP201.

Top Tip: Employers should either uses eFiling or e@syFile™ Employer to submit their declarations. These electronic channels are free, convenient and available 24/7. To find out how to get started follow our simple online instructions.

- You must make a full and accurate disclosure of all relevant information on the EMP201. Misrepresentation, neglect, furnishing false information or non-submission could lead to prosecution.

- Penalties and interest may being charged where the EMP201 is considered as not having been received when:

- All mandatory fields haven’t been filled in.

- The EMP201 is not signed.

- The PRN:

- Consists of 19 digits and is systematically generated when requesting the EMP201.

- Must be used when a payment is made as this number links the payment made with the allocation declared on the EMP201.

- Is used for the whole period, including any revisions submitted.

- Copies of all declarations submitted must be kept for a period of five (5) years.

- Now follow our simple steps to complete your EMP201.

The EMP201 is divided into seven sections:

- Employer details

- Contact Details

- Payment details

- Employment Tax Incentive (ETI)

- Voluntary Disclosure Programme

- Tax Practitioner Details (if applicable)

- Declaration.

The general rules are as follows:

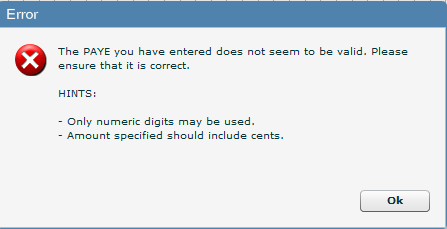

- Pop-up warning message will be shown where the information entered is invalid, e.g.

- Mandatory information is highlighted with a red boarder, e.g.

![]()

- Total/Nett fields are automatically calculated for you.

Completing each section of the EMP201

Once you have filled in your EMP201, you simply send it to SARS via:

-

- e@syFile™ Employer

- eFiling

- Visiting a SARS branch, where an agent will help to fill in the EMP201 electronically.

Top Tip: Faxed, emailed or printed eFiling or e@syFile™ Employer declarations will not be accepted by SARS.

When we have your EMP201 we will send you a receipt.

To see the channels for submitting an EMP201 if you are a Tax Practitioner, click here.

You can pay your EMP201:

- Via eFiling.

Top Tip: All debit pull transactions have been discontinued and only credit push transactions will be accepted. Taxpayers are advised to set-up a credit push or use one of SARS’ alternative methods of payment.

- Over the counter at a bank (Cheques limited to R500 000)

- EFT – electronic funds transfer using internet banking

For the latest payments rules click here.

- An employer can revise an EMP201 that was previously submitted. The amounts that were previously submitted will be pre-populated on the form

- In the instances where SARS has finalised an audit or where SARS has revised the declaration, an employer is only permitted to do an RFC if:

- The PAYE, SDL or UIF liability is increased relative to the audited or SARS revised value. If the RFC results in a decreased liability, an error message will display;

- Where the SARS audit amends the:

- PAYE liability, this may result in a change of the ETI utilised for that specific month. This may also affect the ETI roll over amounts to the subsequent month.

- ETI calculated for the month, this will affect the ETI utilised for that month and subsequent months.

- Note: The change in the ETI utilised will either increase the payable amount or decrease the ETI refund payable to the employer.

- An EMP201 cannot be amended if:

- An agreed estimate was performed by SARS

- The period is associated with a VDP agreement and a return has been submitted in accordance with the agreement

- An audit is in progress and one allowable request for correction has already been submitted.

- If an employer wants to claim an omitted ETI amount, this omitted amount must be claimed in any that subsequent month but by the end of that respective reconciliation period in which the employer discovers this omission. This is in terms of section 9(4) of the Employment Tax Incentive Act which came into effect on 1 March 2017 and forces all employers to claim all its ETI amounts within a reconciliation period.

Example

Employer X omitted to claim an ETI amount of R1000 on the March EMP201. When the omission is discovered, Employer X must not do a request for correction on the March EMP201 to claim this amount. Instead Employer X must claim the R1000 in any subsequent month (April to August). If Employer X does not claim this amount by the latest August, this ETI amount will be forfeited.

PRE-1999 RETURNS

- EMP201 returns for periods prior to 1999 can now be submitted via all channels. This will be limited to the greater of:

- The taxpayer’s year of liability; and

- The legislated start date of the tax.

- The legislated start date for each tax is as follows:

PAYE : 01/03/1991

SDL : 01/04/2000

UIF : 01/04/2002

COMPLIANCE CHECK

- When an original EMP201 is requested, the system will verify the employer’s tax compliance status (TCS). If the employer is non-compliant, the ‘ETI Utilised’ field will be locked on the EMP201 form and the employer may not offset the ETI against the PAYE liability.

For further help call the SARS Contact Centre on 0800 SARS (7277) or visit a SARS branch nearest you.

Frequently Asked Questions

FAQ: What is a payment form?

The payment form serves as a source document that specifies...

Read MoreFAQ: What is a Payment Reference Number (PRN)?

Each payment form is pre-populated with a unique payment reference...

Read MoreFAQ: How do employers make interest and penalty payments?

When paying interest and penalties relating to a specific EMP201,...

Read MoreFAQ: How do I complete and send the Monthly Employer Declaration (EMP201) on eFiling?

In order to complete and send you EMP201 on eFiling,...

Read MoreFAQ: How do I check the status of the Monthly Employer Declaration (EMP201) submitted on eFiling?

To check the status of the EMP201 sent using eFiling,...

Read More